ST. PAUL, Minn. — Gov. Mark Dayton recently opened up to the possibility of a transportation funding plan that does not incorporate a 10-cent increase in the gas tax.

“I’m not going to veto a transportation bill that’s satisfactory in other respects because it doesn’t have a gas tax,” Dayton told the Star Tribune.

Minnesota currently taxes gas at 28.5 cents per gallon, and has done so since July 2012. The 10-cent increase would be more than three times the total increases Minnesota has seen in the last eight years. In June of 2009, the state gas tax was 25.5 cents on the gallon. The current rate sits right in the middle of the U.S., ranking 26th among all states.

Morgan Scarboro, a policy analyst at the Tax Foundation, says that gas taxes are a preferred form of funding for road construction projects.

“Since it adheres to the benefit principle we tend to agree with it. It charges people that are actually using that service,” Scarboro said, “The gas tax also gets the people traveling in your state and they fund the roads too. We’d rather see a gas tax to fund transportation rather than raising income taxes or something.”

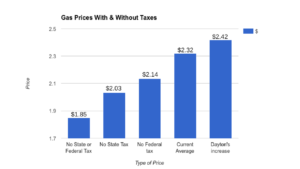

The average gas price across Minnesota currently sits at $2.32 a gallon. If the state gas tax, and the federal gas tax of 18.4 cents per gallon were both repealed, Minnesotans would pay just $1.85 cents a gallon.

According to the Federal Highway Administration, in 2016 the average American drives 13,476 miles per year. In 2015 the average light duty vehicle on U.S. roads had a fuel efficiency of about 22 miles per gallon, according to the Bureau of Transportation Statistics.

At roughly 625 gallons of gas, the difference between the base price and the post-tax price in Minnesota costs drivers $293 a year. Dayton’s 10-cent increase would increase that to $356 per year, with a per gallon price of $2.42. With 57 cents of that being taxes, nearly a quarter of the new gas price would go to the government.

“Gas has a fairly inelastic demand,” Scarboro said, “In the short term, most consumers can’t just stop buying gasoline or go out tomorrow and buy an electric car, so they might carpool more or drive less, but demand doesn’t change dramatically. In the long run, however, as electric and more fuel-efficient cars become more available, consumers can switch to those alternatives, which can have a more significant effect on the demand for gasoline and therefore gas tax revenues.”

Taking into account inflation makes the picture a little more cheery. Analysis done by the Tax Foundation shows that currently the tax rate in 2015 cents is roughly equivalent to the rate prior to 1930. If it had not been for increases in the mid-2000s onwards, the nominal gas tax in Minnesota would likely be lower than it was in the 1930s.