Republican Kendall Qualls raised questions Wednesday about his opponent’s February stock trades, calling them “deeply concerning,” but a spokesperson for Rep. Dean Phillips said the lawmaker hasn’t spoken with his financial advisors since being elected in 2018.

Financial disclosure reports indicate that Phillips was among 37 House members who bought and sold stocks in the early days of the coronavirus pandemic.

Throughout February, Phillips unloaded stocks in companies that were expected to be harmed by the pandemic and purchased stocks in companies that benefited from the public-health crisis, his opponent said in a press release issued Wednesday.

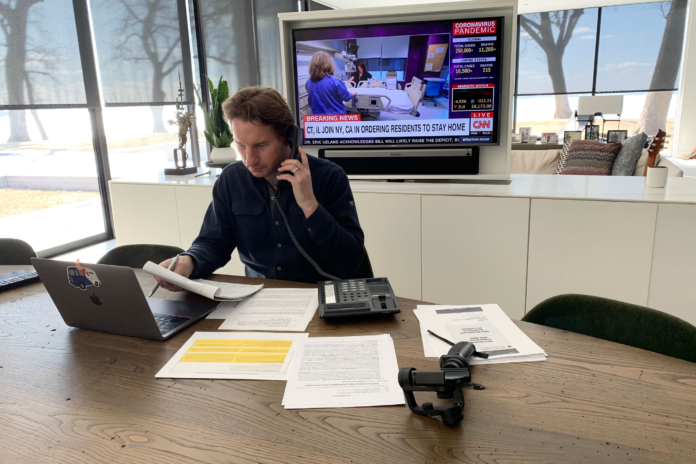

As a member of the House Committee on Foreign Affairs, Phillips participated in a February 27 public hearing on the “U.S. and international response” to COVID-19.

The following day, Secretary of State Mike Pompeo testified before the same committee and was questioned by Phillips. Later that day, members of the House participated in a closed-door coronavirus briefing with top health officials, including Dr. Anthony Fauci, but it’s unclear if Phillips was involved.

That same day, February 28, Phillips purchased stock in Abbott Laboratories, which has received four emergency use authorizations from the FDA for its COVID-19 tests. He also purchased stock in Baxter International, a multinational health care company that has experienced “significant revenue growth” because of the pandemic, a medical industry publication reported.

A purchase for stock in ViacomCBS Inc. is also listed on the first-term congressman’s Periodic Transaction Report, a disclosure form all members of Congress must complete after selling or buying stocks in excess of $1,000. February 28 is again listed as the transaction date.

Phillips sold up to $15,000 in preferred securities in AerCap Holdings, the self-described “world leader in aircraft leasing.” The congressman also dumped stocks in the department store Macy’s and a company called Simon Property Group, a “real estate investment trust engaged in the ownership of premier shopping, dining, entertainment and mixed-use destinations.” Both transactions occurred on February 28.

Overall, Phillips purchased up to $225,000 and sold up to $335,000 worth of stock on February 28. The pandemic was not declared a national emergency until March 13 and the federal government did not ban travel from European countries until March 11.

Phillips, the fifth-wealthiest member of the House, was one of 37 U.S. representatives on both sides of the aisle who made stock transactions during the first weeks of the crisis.

“In the House, there were at least 1,358 transactions, ranging up to a total of $60.5 million by 37 House representatives. Of those transactions, some members of Congress were strategically buying stocks in companies that might see a boost during the crisis, as well as selling stocks that seemed likely to tank,” said a report from the Campaign Legal Center.

The 2012 “Stop Trading on Congressional Knowledge Act” prohibits lawmakers and their senior staff from making trades based on nonpublic information. The Department of Justice opened investigations in March into four U.S. senators who sold stocks after they were briefed on a possible economic downturn. The investigations into all but one of them have been closed.

Qualls, who is running against Phillips in the Third Congressional District, said “the timeline speaks for itself.”

“It is deeply concerning that the same day the House held a closed-door coronavirus briefing, Dean Phillips loaded up on stock in lab testing and medical supply companies while dumping stock in retail and airline holding companies,” he said in a press release.

“As your Congressman, I promise to end the duplicity and put service before self,” Qualls added. “When I was 19-years old, I took an oath to protect and defend our country. That oath has no expiration date.”

Sam Anderson, a spokesperson for Phillips, said Qualls and the NRCC “have been pushing this lie for months.”

“But members of the media have not pursued it because they know it is not based in fact. Dean does not discuss stock trades with his financial management team and has not communicated with his financial advisors since being elected in November of 2018,” said Anderson. “This is a false accusation peddled by a desperate campaign resorting to Trump-style tactics.”