(The Center Square) — After a $1.6 billion projected state surplus and nearly $5 billion expected from the newest stimulus package, Minnesota Senate Majority Leader Paul Gazelka, R-East Gull Lake, says there’s “absolutely no reason to raise taxes.”

A new federal stimulus bill, signed into law by President Joe Biden Thursday afternoon, will provide a total of $4.8 billion to Minnesota’s state and local governments for various uses.

Gov. Tim Walz’s current budget proposal seeks to hike taxes by $1.6 billion, with proceeds funding education and expanding tax breaks to lower-income families. His proposed $52.4 billion budget includes a $4 billion spending increase from the prior biennium budget and the largest proposed spending plan in state history.

Walz aims to increase the corporate tax rate for profitable companies from 9.8% to 11.25%, starting in 2021, which is projected to reap an additional $424 million for state coffers. The increase would bump Minnesota to the second-highest corporate tax rate in the nation behind New Jersey at 11.5%.

That tax increase would affect roughly 34,400 C-corporations that file corporate franchise tax returns annually in the state.

Walz proposed a fifth-tier income tax rate for household incomes above $1 million or a single earner bringing in $500,000 or more, which would shift Minnesota from the fifth-highest income tax — 9.85% on taxable income over $164,400 a year — to the third-highest.

The plan calls to raise the cigarette tax from $3.04 per pack to $4.04, and tax 35% of the gross retail receipts on nicotine devices and tax electronic delivery devices at 95% of the wholesale sales price.

The $1/pack tax increase would skyrocket Minnesota near the highest cigarette taxes in the country below New York and Connecticut, according to Igentax.com.

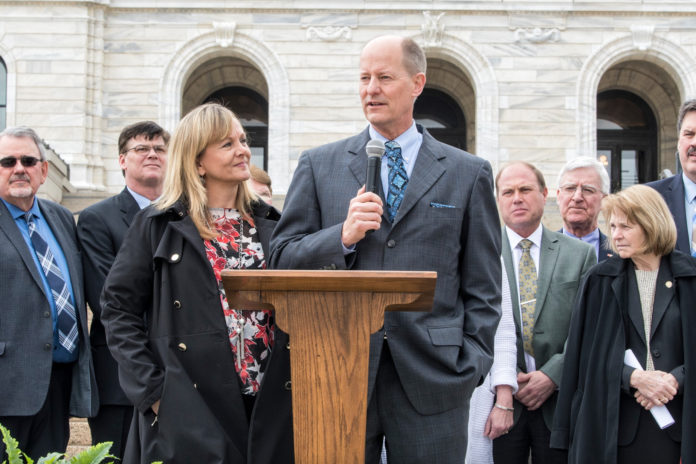

“We started this session committed to balancing the budget without raising taxes. With every week that passes, it’s easier to stick to that commitment,” Gazelka said in a statement. “Minnesota already has a $1.6 billion budget surplus, the stimulus sends $4.8 billion to the state, and revenue collection continues to exceed expectations. There is absolutely no reason to raise taxes on Minnesotans and the Governor should drop all his proposed increases.”

Walz told reporters he’ll release a revised budget proposal next Thursday accounting for the massive windfall of money.