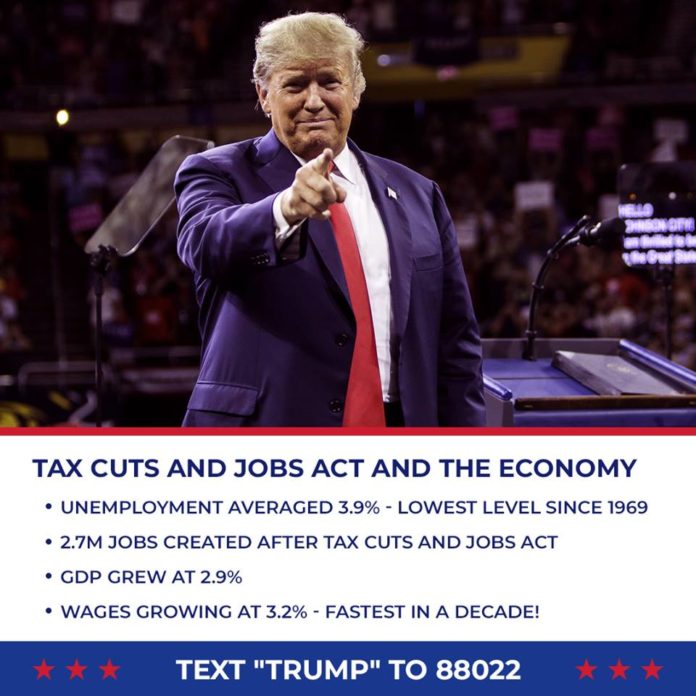

I “celebrated” Tax Day 2019 by attending President Trump’s Roundtable Discussion at Nuss Truck & Equipment in Burnsville, MN. Focusing on the economy and tax policy, the president sat down with multiple small to mid-size business owners and talked about the benefits seen from the 2017 Tax Cut and Jobs Act. The event saw a big turnout of presidential supporters with a guest appearance made by CAIR protestors.

Opening the discussion, President Trump mentioned the positive effects seen in Minnesota due to the tax cuts. Including the 3.1% unemployment rate, jobless claims in Minnesota being at their lowest level in 22 years, Minnesota families saving more than 5 billion dollars on their 2018 tax bills, and the average Minnesotan’s income gain of $1,700. Not to mention, new business applications have increased by 20% and 1.2 million Minnesotans saw a decrease in utility bills.

The true testimony to the Tax Cut and Jobs Act came from hardworking business owners. Being a daughter of a small business owner myself, I know first-hand how difficult government taxation and regulation can be. Trump’s tax policy provided a 20% small business deduction, reduced income taxes, and extended expensing through section 179 for small business. This resulted in Carlos Gazitua, President of Sergio’s Restaurant in South Florida to offer, for the first time ever, 401k’s to all 650 of his employees. Nuss Truck & Equipment along with multiple other businesses were able to give bonuses, buy new equipment, and provide more jobs. Christine, who owns a small corner market in a tiny town 45 miles southwest of Pittsburgh, was able to keep and sustain her business due to the tax reductions. These were only a few examples of what came of the 2017 tax cuts.

Not surprisingly, President Trump’s visit wasn’t the highlight of everyone’s Monday. DFL Party Chairman Ken Martin stated about Trump’s visit, “If Donald Trump expects a warm welcome in Minnesota, he’ll be sorely disappointed. He’s here to sell a record of broken promises, lies, and attacks on families across our great state. It won’t work…The tax scam Donald Trump will be trumpeting was a massive giveaway to the rich and powerful, paid for on the backs of the elderly, the sick, the young, and families in need…”

Let’s deconstruct this. What Chairman Martin said is a widely accepted talking point among democrat politicians and voters, which is built upon a fundamental misunderstanding of taxes and economics. The Tax Cut and Jobs Act, on the national scale, resulted in 6 million new jobs with over 80% of Americans seeing their taxes decrease. Even the New York Times posted a headline begrudgingly admitting that we received a tax cut. As I already described, small businesses have seen a massive boost, families are taking home more money, and Minnesota is seeing record low unemployment. I’d hardly call that an attack.

However, the main talking point fueling the left’s disdain for Trump’s tax cuts is the fact that the wealthy are also seeing their taxes go down. Yes, it is true that the richer you are the more money you see in tax reductions. That is because the richer you are the more money you pay in taxes. IRS data shows that individuals in the top 1% of earners pay more in income taxes than the bottom 90% of taxpayers combined. Although, just because everyone is seeing a decrease in taxes doesn’t mean the percentage of tax contribution goes down. According to the Tax Policy Center, the top 20% of earners paid 84% of all federal income taxes in 2017 and paid 87% in 2018.

We didn’t see a “benefit” to the rich, we saw a 3% tax contribution increase. When Chairman Martin referred to the tax cuts as a “scam” that is a huge giveaway to the rich, this would also assume that the government is quite literally giving rich people money. Of course, this is not only false, but it’s also deliberately dishonest. Taxation is the act of forcibly taking a citizen’s earned money through legislation. Tax cuts are not a giveaway. Tax cuts are the government appropriating less of your earned dollars.

Now, let’s look at the second part of that statement, “paid for on the backs of the elderly, the sick, the young, and families in need.” This statement assumes two things. One, that these people are being marginalized by the tax cuts. Two, that the wealthy are only rich at the unwilling expense of these groups of people. No, we haven’t in fact seen any negative impacts from the tax policy on welfare programs or other government assistance that would help these people out. No, the rich didn’t get to the top tax bracket by stealing money from the young, elderly, sick, or struggling families. The beautiful thing about capitalism is that you get rich through consenting transactions. You can only make money by offering a good or service that other people are willing to voluntarily pay for. You cannot offer a faulty product or conduct a scam and find long term success. You will get caught. You will go to jail. So, these “nasty” rich people earned their money by innovating something consumers wanted and decided to pay for in a mutually beneficial transaction. A CEO did not become a CEO by going into neighborhoods and robbing people.

I am not one that feels the need to defend President Trump at every turn. I praise the president when he does something well and I call him out when he does something not so well. With that being said, I am completely stunned by the liberal backlash to economic growth and American’s keeping more of their money. The bending over backwards to construe a false narrative on the effects of the Tax Cuts and Jobs Act by actively ignoring not only economic fact but also the success stories of businesses and the average worker comes off as a true demonstration of a partisan hit job. All seemingly because it happened to be this administration’s tax policies. It compels me to ask, do you actually hate that people get to keep more of the fruits of their labor or do you just hate Trump?

***

Do you like Alpha News? Help us reach more people in 2019 by donating today

Alyssa Ahlgren

Alyssa has her Bachelor’s in Business Administration and currently works as an analyst in corporate finance. She grew up in northern Wisconsin and is a former collegiate hockey player. Alyssa is pursuing her passion for current events and politics through writing and being an advocate for the conservative movement.