(The Daily Signal) — Thanksgiving is meant to be devoted to thankfulness for family and the many other blessings in each of our lives. But, as most American families sit down to a Thanksgiving meal on Thursday, they will also be met with a specter looming over their financial life — namely, Bidenomics.

Rising consumer prices, falling real incomes, a slowing economy, and housing costs that are through the roof are all just some of the economic maladies visited on American families this year by way of the economic policies of the Biden administration.

Bidenomics is, tragically, nothing new. It is the doubling down of an age-old approach to economic policy, the idea that the government is better at using your money than you are. Through reckless federal deficits and money printing, the Biden administration has sown the seeds of economic malaise.

The American Farm Bureau Federation annually publishes the price of a “Classic Thanksgiving Dinner” that attempts to capture the experience of a typical American family.

The federation’s reported price, pre-Biden, for a Thanksgiving meal for 10 in 2020 was $46.90, but now, for 2023, it is $61.17 — an increase of more than 30.4%.

This price increase puts an astonishing burden on American households. However, that is only one of many price jumps during the Bidenomics era. Across all categories of food at home, prices are up more than 20% from when President Joe Biden took office, while energy prices are up well over 35%.

This rampant level of inflation hasn’t, however, been a random or unforeseeable occurrence. It’s the direct and predictable result of massive upticks in federal spending. Whenever the government spends, it does so by forcefully taking funding out of the hands of hardworking Americans.

When a business or household borrows, it does so because the lender has faith that the borrower will be able to earn enough money to pay back the loan in the future. When a government borrows, however, that isn’t the case.

Governments are not capable of earning money through merit alone. Nationalizing industries or raising taxes are clearly coercive. Printing more money is another form of theft, forcefully pouring water into the wine of every American’s life savings.

Since these methods are coercive, government borrowing is as well. When a government borrows money, it agrees to use its unique power to pay back the loan with someone else’s money.

For decades, the Left has propagated the lie that government deficit spending was a magical free lunch because the government didn’t hike taxes to pay for massive spending increases. As inflation has shown, in the end, there is no free lunch, just the government eating your lunch at the money market buffet table.

As the federal debt has ballooned by 44% from $23.44 trillion to $33.75 trillion during the COVID-19 pandemic, so too has the inflation tax imposed on every American.

With Biden and so many other politicians committed to deficits at such an absurd level, there is only one further policy outcome: hyperinflation or sky-high interest rates that crowd out economic growth.

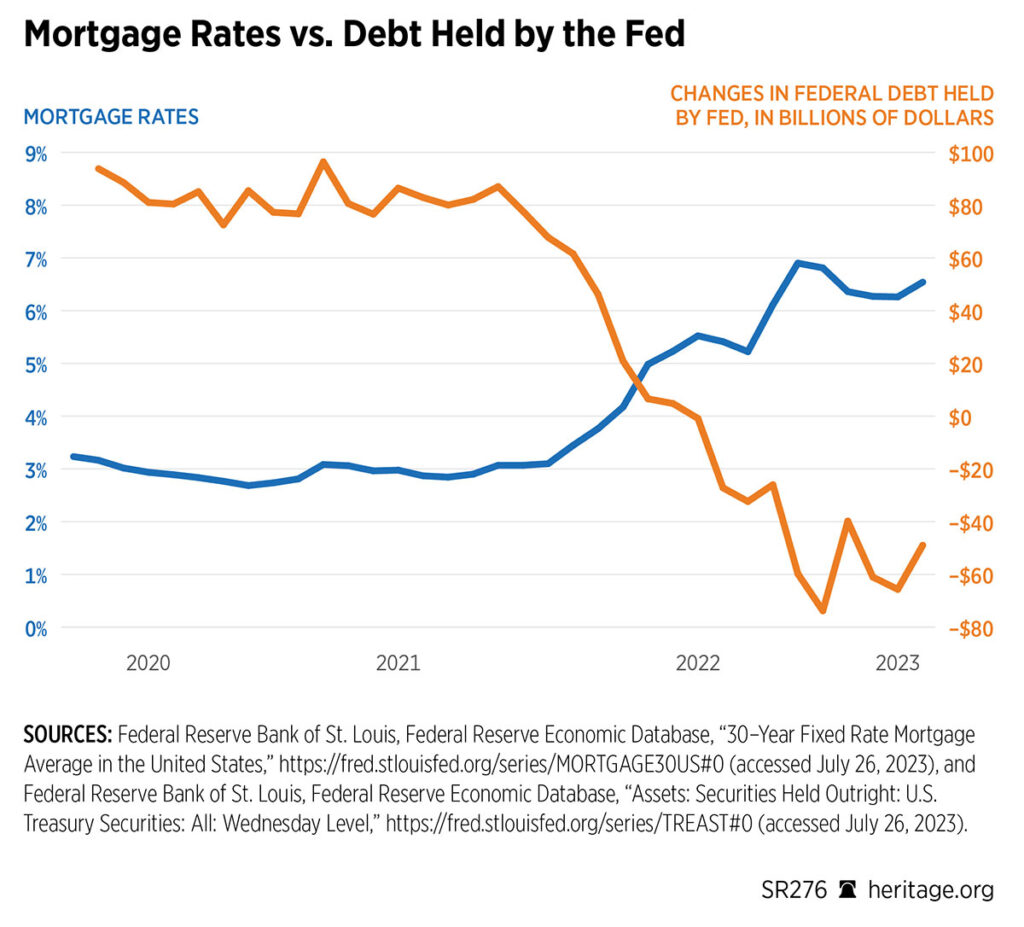

In early 2022, the Federal Reserve switched course, having let prices jump more than 12% in less than two years, and decided to start increasing interest rates by constricting the money supply. While this has slowed inflation, it by no means has stopped it — or the harm it has done to household finances.

Despite the Federal Reserve’s actions, prices are now up more than 20% since the pandemic started and mortgage rates have spiked from around 3% to 7.5%, pushing that pillar of the American dream, homeownership, even further out of reach for tens of millions of Americans.

This goes to show that if the federal government drives up its deficits and spending, there will be nowhere for families to hide. The following chart shows that as the Federal Reserve stopped printing money to cover federal deficits, it traded an inflation crisis for an interest-rate crisis.

That has dramatically pushed up the first year’s interest cost on a typical mortgage from around $8,500 when President Donald Trump left office to well over $24,000 now.

From Reagan through Trump, annual interest payments on a new mortgage, with 20% down on a median house, were stable.

Under Biden? Up from $8,500 to almost $24,300…over 285% of the level under Trump! Thanks Bidenomics… pic.twitter.com/CegrUuLOW6

— Richard A. Stern (@RichAStern) October 28, 2023

We can do better than trading high inflation for high interest rates as the economy is slowly strangled to death. This all speaks to the immortal wisdom of President Ronald Reagan, who said, “The nine most terrifying words in the English language are: ‘I’m from the government, and I’m here to help.’”

As the nation comes together this Thanksgiving to be with loved ones and count their blessings, let us recommit to the principles that led us to such prosperity.

May lawmakers reduce the crushing size and scope of the government to allow Americans to keep the fruits of their labors and get back to building a brighter future for generations to come.