(Center of the American Experiment) — Minnesotans are having their incomes and living standards squeezed by inflation. The national figures get the headlines, but less known is the fact that the situation is especially bad here.

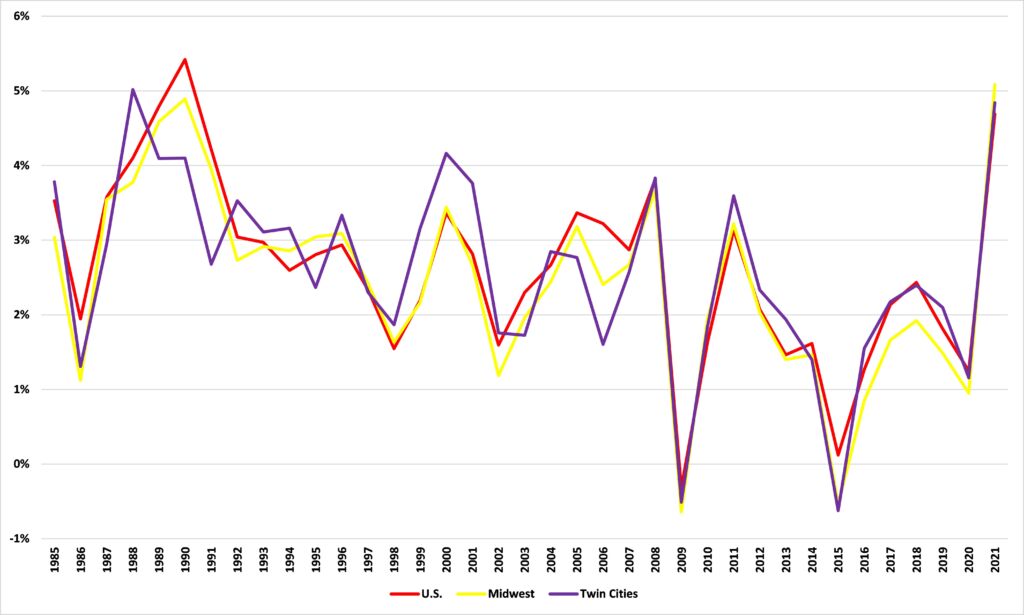

Figure 1 shows the percent change from year to year for the Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, Consumer Price Index for All Urban Consumers: All Items in Midwest, and Consumer Price Index for All Urban Consumers: All Items in Minneapolis-St.Paul-Bloomington, MN-WI. We see that from 2020 to 2021, the percentage increase in the Consumer Price Index (CPI) was 4.7 percent for the United States, but 4.8 percent for the Twin Cities and 5.1 percent for the Midwest. This latter number represented the biggest lead for the Midwest over the national inflation rate since 1982.

Figure 1: Percentage change in CPI, United States, Midwest, and Twin Cities

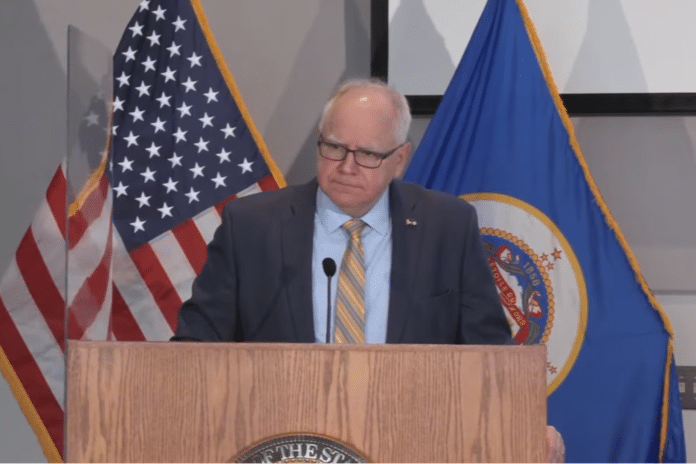

But while Minnesotans are seeing their incomes squeezed, the same cannot be said of their government. On Dec. 7, Minnesota Management and Budget (MMB) released its budget forecast for Fiscal Year 2022-23. Government spending is forecast to rise, in real, inflation-adjusted terms, by 2.7 percent from 2020 to 2023 but even this will not keep up with bumper revenues: a structural budget surplus of $4.0 billion is forecast for the FY 2022-23 biennium and $5.9 billion for the FY 2024-25 biennium.

One way the state government could help hard-pressed Minnesotans dealing with inflation created by the federal government would be to reduce its cost to them with a cut in the state’s excessively high tax rates. Indeed, with a structural surplus, this is what the state government ought to be doing. If the state government is taking more money than it thinks it will need from people already struggling with a rising cost of living, tax rate cuts are the way to go if you are serious about helping them.

Sadly, Gov. Walz sees this as an election-year opportunity to shower you with your own cash — but with his name stamped all over it. Thursday, he announced his plans for the surplus of your money that the state government is going to collect. They included so-called “Walz checks,” a one-off payment of $175 for single tax filers and $350 for married filers, subject to an income cap ($164,400 for single filers and $273,470 for married filers). State officials estimate that 2.7 million households will qualify for a total of $700 million in one-time payments.

“Walz checks” isn’t a name made up by the governor’s opponents, it is actually what his own office calls them in his plan. Politics is rarely grubbier than when a politician tries to buy your vote with someone else’s money.

Exacerbating this is the fact that these checks won’t make much of a difference to most Minnesotans. With a median household income of $71,306 and an inflation rate of 7.0 percent in the year to November, that median household saw a real-terms cut in its income of $4,991 from 2020 to 2021. Faced with that, a check for $350 isn’t going to do very much for the average Minnesotan.

This proposal is both bad policy and grubby politics. With a structural surplus, permanent tax rate cuts are a vastly better way to help ordinary, hard-working Minnesotans than one-off checks that will cover only a fraction of their losses to inflation.