The Crow Wing County Board approved a seventh straight year of property tax levy reductions on Tuesday night, reports the Brainerd Dispatch.

The upcoming year’s totals will be the smallest tax levy Crow County residents have been asked to pay since 2008. County Administrator Tim Houle told the Brainerd Dispatch that no other local government in state history has accomplished seven consecutive decreases in its levy.

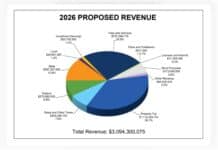

Of Crow Wing County’s $83.2 million budget for 2017, $34,385,687 will come from county property tax collections. This is 0.12 percent less than the year prior, or a total of $41,312 less.

The resolution passed at the county’s annual public hearing on its budget and levy by a vote of 3-2. Commissioners Paul Thiede and Rosemary Franzen were the no votes.

Thiede was concerned about a $40,000 budget increase in order to finance a shared housing rehabilitation coordinator with the Brainerd Housing and Redevelopment Authority.

“I do not like surprises, and that HRA issue was a big one and it came at a very late hour,” Thiede told the Brainerd Dispatch. Thiede said “unsatisfactory answers” regarding that issue were what caused him to vote no, and stated it was not a reflection on the negative levy trend.

Franzen’s said her no vote was due to a lack of clarity on County Attorney Don Ryan’s budget proposal. Ryan told the board just prior to the meeting that neither his original budget proposal nor the amended version had been included in the final budget recommendation.

The largest portion of the property taxes will go towards funding public safety programs. This is about 26 percent of the $34.4 million levy. Community services will make up 22 percent of the levy, five percent more than the prior year.

The highway department will receive six percent, which is down four percent from the year prior. This is due in part to a new local option sales tax, the proceeds of which will support highway maintenance. As a result $1.3 million of the levy which was previously needed to fund the maintenance can be spent elsewhere.

Of the remaining levy, 15 percent will be used to pay down debt, 12 percent will fund administrative services, 10 percent will fund governance services, five percent for land services, and 4 percent for capital projects.