Rep. Tom Emmer has warned that thousands of proposed new IRS agents could easily be “weaponized against conservatives.”

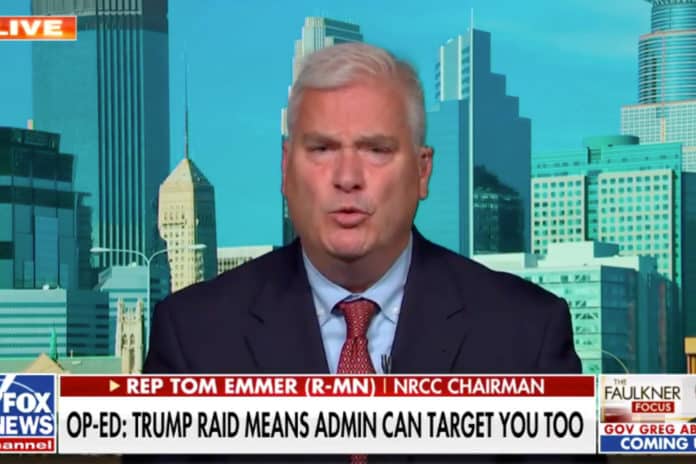

The Minnesota congressman appeared on Fox News Wednesday morning to discuss the recent FBI raid of former president Donald Trump’s Mar-a-Lago residence, saying “everyone should be concerned” about the weaponization of the Justice Department, which oversees the FBI.

“Republican, Democrat, other — everyone in this country should be concerned when the Department of Justice has been weaponized against American citizens, and in this case by the Biden administration against their political opponents,” he said.

Emmer added that the same dynamic could play out with tens of thousands of new IRS agents, a proposal included in the so-called “Inflation Reduction Act” that was passed in the U.S. Senate along strict party lines. The bill has now moved on to the House of Representatives.

“They want to get 87,000 more IRS agents with the bill we’re going to vote on on Friday. Think about that for a second,” he said. “You can’t tell me the IRS is not going to be weaponized against conservatives, just the way it was under Barack Obama. Everyone should be concerned with this abuse of power.”

Every single American should be alarmed at the Biden Administration’s weaponization of our justice system.

If they’re willing to go after a former President, what’s to stop them from using their proposed 87,000 new IRS agents to go after you? pic.twitter.com/1G38ZJupCO

— Tom Emmer (@RepTomEmmer) August 10, 2022

Roughly $45.6 billion of the $80 billion in IRS funding will go towards “enforcement,” leading many to believe the IRS will use its new agents to audit the taxes of more Americans, specifically those of middle-to-lower-class backgrounds.

IRS Commissioner Charles Rettig, however, has claimed that targeting middle-to-lower-class Americans is not the purpose of the increased funding and hiring.

“The resources in the reconciliation package will get us back to historical norms in areas of challenge for the agency — large corporate and global high-net-worth taxpayers — as well as new areas like pass-through entities and multinational taxpayers with international tax issues, where we need sophisticated, specialized teams in place that are able to unpack complex structures and identify noncompliance,” he wrote in a letter to the Senate last week.

“These resources are absolutely not about increasing audit scrutiny on small businesses

or middle-income Americans.”

Conservative fears about weaponization of the IRS are likely grounded in a past scandal as well. In 2013, IRS officials were caught targeting dozens of conservative groups seeking tax-exempt status.

Some 40 government-skeptical conservative groups were targeted with invasive application questions and unnecessarily long delays.

In 2017, four years later, the IRS formally apologized for their mistreatment of those groups.