(Daily Caller News Foundation) — The federal government’s debt grew more than twice the amount that the economy did in the fourth quarter of 2023, as measured by gross domestic product (GDP).

![]()

Real GDP showed above-trend growth in the fourth quarter of 2023, rising 3.3% year-over-year, equating to a $328.7 billion increase to the U.S. economy, according to the Bureau of Economic Analysis (BEA). In contrast, the federal government held nearly $33.17 trillion in debt at the end of the third quarter of 2023, which jumped to just over $34 trillion by the end of the year, equating to an over $800 billion deficit gain in the fourth quarter, according to the Treasury Department.

“What we’re effectively doing on a national level is racking up debt faster than we’re growing our income,” E.J. Antoni, a research fellow at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget, told the Daily Caller News Foundation. “At the same time, the cost to service a dollar of debt is rising. This is a deadly combination because it leads to a debt death spiral. This GDP report showed annualized interest on the debt breaching $1 trillion for the first time ever. While runaway consumer spending is not sustainable either, runaway government expenditure growth is worse because the government spends money so inefficiently. Thus, you get less ‘bang for your buck,’ so to speak.”

The federal government spent $659 billion in fiscal year 2023 just servicing the country’s national debt, an increase of $184 billion from the previous year, according to the Congressional Budget Office. Interest on the national debt is estimated to cost more than $13 trillion over the next decade, according to the Committee for a Responsible Federal Budget.

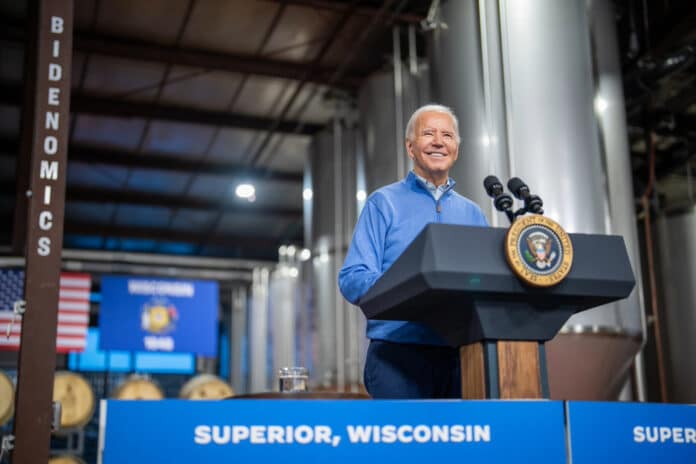

The federal debt has ballooned in the past seven years, rising more than $8 trillion during the Trump administration, bolstered by emergency COVID-19 pandemic spending, and already more than $6 trillion under President Joe Biden, according to the Treasury Department. Despite the huge budget deficit, the American Enterprise Institute estimates that the government still has around $93 trillion in unfunded liabilities for programs like Medicare and Social Security.

Government consumption expenditures and gross investment made up around 17% of the total economic growth seen in the fourth quarter, lower than the average for the whole year of 27.2%, according to the BEA. Government consumption rose 3.3% for the fourth quarter year-over-year, led by federal nondefense spending, which increased 4.6% year-over-year.

Comparing debt to GDP is apples and oranges in some sense b/c it's a stock vs a flow; what matters is interest to income, which is skyrocketing at the fastest pace since '46, right after WWII; even optimistic case w/ slower rate of increase will double previous % record by 2030: pic.twitter.com/oWFYOCO5QO

— E.J. Antoni, Ph.D. (@RealEJAntoni) January 25, 2024

The largest contributor to growth in the fourth quarter was personal consumption, increasing by 2.8% year-over-year and contributing to 58% of the overall GDP gain, according to the BEA.

Strong consumer spending has come in tandem with an increase in personal debt and financing by Americans, with aggregate credit card debt for Americans climbing to over $1 trillion for the first time ever in 2023. American consumers have also turned to services like buy now and pay later and layaway to finance their purchases as prices and expenses rise.

“It’s very concerning that the growth in government expenditures has outpaced the growth in consumer spending for the last six quarters,” Antoni told the DCNF. “Furthermore, government expenditures only include what the government directly buys and excludes all transfer payments. Thus, it is really understating just how much of the economy today is controlled, directly or indirectly, by government … This debt-fueled spending binge can’t last forever.”

The White House did not immediately respond to a request to comment from the DCNF.