Five DFL legislators who have previously told their constituents they would support a repeal of the state tax on Social Security income voted down an effort on the House floor Monday evening to do just that.

Following news Monday morning from the Office of Management and Budget that Minnesota’s state coffers contain a $17.5 billion budget surplus, Republican legislators attempted — and failed on a near party-line vote — to pass on the House floor a bill that would repeal taxes on Social Security income for Minnesotans who receive the federal benefit. Rep. Dan Wolgamott, DFL-St. Cloud, was the lone DFLer who voted with Republicans.

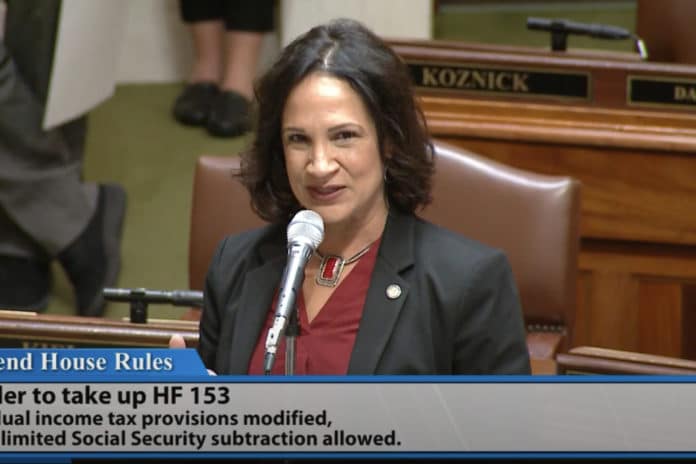

HF153, sponsored by Rep. Greg Davids, R-Preston, and 11 other Republicans, has yet to be scheduled for a hearing in the DFL-controlled House Taxes Committee. That frustrated Republicans enough that they attempted to bring the bill directly to the House floor on Monday evening, declaring it an urgent issue that deserves bipartisan support in the wake of the updated February budget forecast announced earlier in the day.

Language in the bill would essentially repeal existing statute and allow all Minnesotans receiving Social Security income to deduct the full amount of those benefits from their tax returns.

If approved, Minnesota would join 39 other states in eliminating tax on Social Security. In total, the bill would take about $1.5 billion in tax revenue out of the state budget.

DFL legislators on the House floor wasted no time debating the issue with their GOP counterparts and defeated the motion by Rep. Lisa Demuth, R-Cold Spring, to suspend House rules and bring the bill for a vote on the floor.

DFLers in House and Senate on record supporting repeal of Social Security tax

Five of the six DFL House members who campaigned on or publicly committed to repealing the state tax on Social Security income voted against taking up the measure on the floor. Those five include representatives: Dave Lislegard, Matt Norris, Jeff Brand, Zack Stephenson and John Huot. All five DFLers are on record as having told constituents they supported repealing the Social Security tax and were called out by name on the House floor by Demuth.

“I have a list of colleagues, members from the other side of the aisle that have supported this, both in your campaigns and since we’ve been in session, that you are supporting full elimination of the tax on Social Security,” Demuth said. “All are saying we need to end the tax on Social Security.”

Eliminating the tax on Social Security income was a promise that every politician made on the campaign trail.

Then Election Day happened…

What changed @MinnesotaDFL? pic.twitter.com/VKKhscJVd1

— Elliott Engen (@elliottengenMN) February 28, 2023

House Majority Leader Rep. Jamie Long, DFL-Minneapolis, said approving the bill on the House floor just hours after the February budget forecast was announced “doesn’t seem to be something we should do on the fly. We should be having a full committee hearing and process” on the bill in the House Taxes Committee.

When Minority Leader Demuth pressed House Taxes Chair Rep. Aisha Gomez on when the bill might receive a hearing, Gomez, a DFLer from Minneapolis, dodged the question and said she plans to hear another bill that offers a more limited relief on the Social Security tax “that doesn’t cost $1.5 billion and doesn’t blow a giant hole in our budget.”

Rep. Ann Neu-Brindley, R-North Branch, pointed to the nearly $2 billion in new spending the DFL majority has already passed during the first seven weeks of the legislative session before the February budget forecast was announced. That includes a universal school meals program Democrats approved that will cost more than $400 million.

“You’ve been spending money hand over fist and now we have the chance to spend it on something that matters — spend it on our senior citizens who need this tax relief.”

Over in the state Senate five DFLers are on record supporting repeal of the Social Security tax. Despite that, Gov. Tim Walz told media members during his February budget forecast press conference on Monday that he will not support a full repeal of taxes on Social Security income, a departure from his stance on the issue during legislative negotiations in May 2022.

“I’m not gonna push for a total elimination, it makes no sense to me,” Walz said Monday, indicating he’ll support a version of the bill that would put an income cap on those who would receive Social Security tax relief. “Again, all the angst over people making millions of dollars, trust me, they will be just fine.” Walz claimed the DFL-sponsored bill would provide Social Security tax relief for 386,000 Minnesotans. But he didn’t mention that there are now more than 900,000 Minnesotans age 65 and up living in Minnesota.

Hank Long

Hank Long is a journalism and communications professional whose writing career includes coverage of the Minnesota legislature, city and county governments and the commercial real estate industry. Hank received his undergraduate degree at the University of Minnesota, where he studied journalism, and his law degree at the University of St. Thomas. The Minnesota native lives in the Twin Cities with his wife and four children. His dream is to be around when the Vikings win the Super Bowl.