(The Center Square) — Data scientists from the Pandemic Response Accountability Committee identified nearly $38 million in potentially improper or fraudulent pandemic loans were obtained using Social Security numbers of dead people.

The loans were made through both the COVID-19 Economic Injury Disaster Loan program and Paycheck Protection Program.

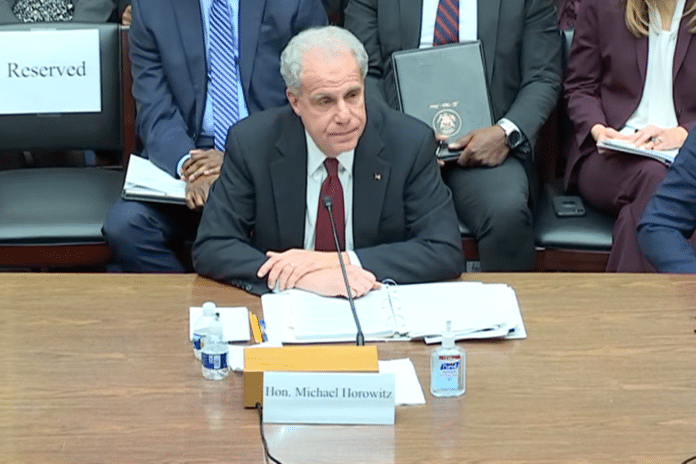

Pandemic Response Accountability Committee Chairman Michael Horowitz testified in February before the House Committee on Oversight and Accountability that PRAC used a verification process to determine that 69,000 questionable Social Security numbers were used to obtain $5.4 billion in pandemic loans and that another 175,000 questionable Social Security numbers were used in applications that were not paid.

As a follow up to a January report, the Pandemic Response Accountability Committee said it took a closer look at those Social Security numbers that belonged to people who had died.

“Using data available from DNP’s matching process and date of death information, the PRAC’s data scientists found that 3,222 of the 15,307 deceased individuals’ SSNs were used on COVID-19 EIDL/PPP applications across three analytic scenarios,” according to the report.

In some cases, these COVID-19 Economic Injury Disaster Loan program and Paycheck Protection Program applications were submitted after the SSN owner’s date of death; in other cases the applications were submitted both before and after the SSN owner’s date of death and in some cases the applications were submitted before the SSN owner’s date of death, but were paid after the date of death, according to the report.

PRAC data scientists determined that funds were disbursed in connection with applications using 305 of the 3,222 SSNs, totaling nearly $38 million in potentially improper or fraudulent payments between the two programs.

“The work of the PACE makes clear why sustained data analytics capability, beyond the PRAC’s sunset and the COVID-19 pandemic, would be a gamechanger for the oversight community,” Horowitz said in a statement. “Retaining an antifraud analytics center will ensure the federal government has the resources it needs to conduct effective oversight of all federal expenditures.”

Horowitz testified in February that federal agencies failed to use some of the tools at their disposal to prevent fraud, including the Do Not Pay list. The U.S. Department of the Treasury had set up the list of suspicious payees who should trigger additional screening. He said advance screening with the U.S. Department of the Treasury Do Not Pay list could have saved taxpayer money.