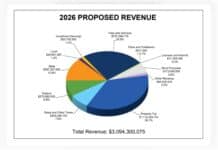

The Hermantown City Council wants state lawmakers to approve a resolution to place a half-cent sales tax increase on the November ballot.

Council members this week passed a resolution 4-1 to consider increasing the city’s sales tax by 0.5 percent for 20 years.

Revenue generated from the proposed tax would raise up to $28 million over the 20 years. The money would be used to improve a hockey stadium, trails and other recreational areas.

The resolution would have to be approved by the House and Senate Tax committees in the state legislature to reach the November 2020 ballot.

The estimated revenue from the sales tax is $1.5 million per year, with expected debt service for the three projects of $1.4 million. The city currently generates about $3 million per year in sales taxes.

If passed, Hermantown’s sales tax would reach 8.875 percent, tying with Duluth and Walker for the highest sales tax in the state.

The initial projected project cost is $19 million, with a 20-year cost of $28 million, counting interest, that would renovate the Hermantown Hockey Arena area, reconfigure Fichtner Field, and extend trail paths to connect Hermantown to trails in Duluth and Proctor.

That includes a baseball and softball field, a skate park and a basketball court.

Joe Wicklund, Hermantown’s Communications & Community Relations manager, told The Center Square the proposal is pushed by momentum from the Essential Wellness Center, which was partly funded by a sales tax increase.

Wicklund said the center brought Southern St. Louis County together. It reached its 5,000 member goal in five months, a goal originally slated for five years.

That’s paired with a goal to increase community health outcomes in St. Louis County, Wicklund said, through increased access to recreational activities.

“This opens up those opportunities whether you’re 8, 9, or 10 years old, or 80 or 90 years old,” Wicklund said.

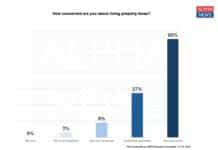

Council Member Gloria Nelson voted against the proposal, citing concerns about a roughly 10,000-person town carrying that debt load.

The city council meeting agenda raises concerns that property taxes could be raised if the sales tax doesn’t generate enough revenue to cover costs.

“This process is good government: the chance for a local city council to extend an option to the legislature, and then we move it back to the most important people in the equation: the voters,” Wicklund said.

Wicklund said the sales tax, unlike property taxes, gave consumers an option to shop elsewhere.

A draft Economic Impact Study projected that the hockey arena could inject $2.3 million into the local economy.

Wicklund said voters would cast the final decision.

“What is exciting is that this is the first step in a process that can include a great deal of community engagement and citizen feedback,” Wicklund said. “This isn’t something that’s decided on behalf of the city council already, it isn’t decided in the Minnesota Legislature already, or if it’ll even be on the ballot.”

The resolution will be sent to the Legislature on Jan. 31.