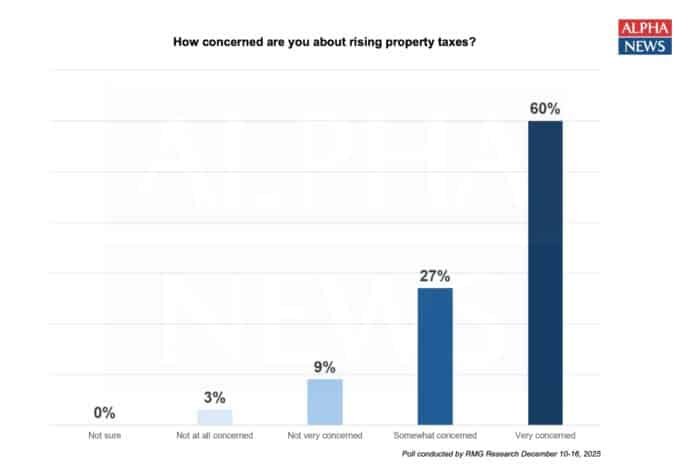

An exclusive Alpha News poll found that 60% of those surveyed are very concerned about rising property taxes; another 27% of respondents said they are somewhat concerned.

The poll, which surveyed 800 registered voters across Minnesota, was conducted by RMG Research from Dec. 10 through Dec. 16. RMG Research is run by famed pollster Scott Rasmussen, the founder of Rasmussen Reports and one of the co-founders of ESPN.

Taken together, a combined 87% of respondents are either somewhat concerned or very concerned by increasing property taxes. The remaining 12% of those surveyed are either not very concerned, or not at all concerned, by rising property taxes.

The poll comes as counties, cities, and school districts across Minnesota finalize their 2026 budgets and lock in their new property tax rates for next year.

In Hennepin County, commissioners raised their property tax levy by 7.79%. Meanwhile, Ramsey County approved a budget that will increase property tax collection by 8.25%, and Anoka County commissioners approved a 9.4% increase.

Of course, an individual property tax bill is a collection of county, city, and school district property taxes. As such, a homeowner or business could see their property tax bill increase sharply if their county, city, and school district all authorize higher rates.

Commissioners in Carver County approved a tax levy increase of 8%. However, the county noted that the 8% increase is comprised of “a 6 percent base levy increase and a 2 percent ‘Legislative Impacts’ surcharge that reflects recent federal and state changes that shifted costs, requiring the County to budget for new financial impacts.”

Similarly, a group of 98 Minnesota mayors recently pinned property tax increases on the actions of Minnesota’s state government.

In a letter published Monday, the mayors said local property tax increases “are not simply local decisions; they stem directly from state policies, mandates, and cost shifts that leave cities with no choice but to pass these burdens onto homeowners and businesses.”

The collection of mayors also noted that “every unfunded mandate or cost shift forces us into difficult choices: raise taxes, cut services, delay infrastructure, or stretch thin city staff even further.”

This story is the third in a series about the Alpha News/RMG Research poll. Crosstabs and toplines for the poll are available here and here.