Last Wednesday, Minnesota Republican Congressmen Erik Paulsen (MN-03) and Tom Emmer (MN-06) along with Democrats Betty McCollum, (MN-04) and Keith Ellison (MN-05) joined Senators Amy Klobuchar and Al Franken to send a letter to Treasury Secretary Jacob Lew and National Security Advisor Susan Rice asking for an update on the Obama administration’s efforts to establish a “sustainable, long-term framework for establishing money transfers” to Somalia.

A copy of the letter can be seen by clicking below:

According to the letter “International remittances represent 25% of Somalia’s gross domestic product.” The Congress members stated that “to protect our national security and help prevent a humanitarian crisis, we must continue to work toward a long-term solution to keep remittances flowing to Somalia.”

Ellison and Emmer are co-chairs of the newly formed Somalia Caucus and have made the money-transfer issue one of their top priorities.

Paulsen has also been actively engaged on the issue. Ellison and Paulsen co-sponsored The Money Remittances Improvement Act (HR 4386) which became law in August of last year. The bill authorized federal and state regulators to share information about money remittance companies. It also took away the requirement that the money service businesses (MSB’s) undergo separate IRS examinations and instead rely on state exams that meet federal standards.

Ellison, Paulsen, Klobuchar, and Franken sent a letter to Secretary of State John Kerry in February asking him to develop an emergency plan to address the cutoff of the money transfers to Somalia. In February of this year, the small Merchants Bank of California, which according to U.S. News and World Report was responsible for transferring between 60-80% of the total remittances to Somalia, announced it would be cutting off the service. Cash transfers from U.S. banks had been sending about $200 million per year to Somalia according to the Washington Post.

The issue began to heat up in 2012, when American Banker reported that thousands of Somalians in Minnesota organized and demanded that U.S. Bancorp and Wells Fargo provide remittance services or they would close their accounts. American Banker reported that Tom Joyce, a spokesman for U.S. Bancorp, said in an interview. “We have a responsibility to the nation and the regulators to adhere to the laws and ensure that the money that gets transmitted ends up in the right hands.”

In Somalia, money transmission is run through a loose network called “hawalas” which relies on trust and produces no paper trail. According to the International Business Times “The U.S. government identified hawala when it was a primary method used by al Qaeda to send and receive cash.”

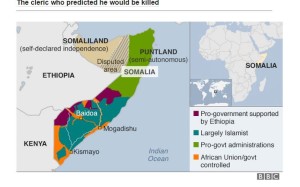

Somalia has no functioning government or banking system and has been in a civil war since 1990. According to the BBC, as of April, the Islamic terrorist group Al Shabaab dominates many rural areas of Somalia. (see map below) Just last week the al Qaeda-affilated group took control of “a sizeable town in central Somalia” according to Reuters. In the same news item, Reuters reports on the unstable and chaotic situation on the ground:

Residents said they had been treated brutally by both sides, but some said they welcomed the return of al Shabaab.

“The problem is that the government cannot keep control of the town and it does not want al Shabaab to rule it,” said local elder Nur Ibrahim. “Government troops rape, rob and kill us. Al Shabaab also punishes anyone who sells items to the government.

With the largest Somalian population in the country that continues to grow rapidly in Minnesota, it’s likely that members of the state’s congressional delegation will continue to push for re-establishing money transfers to Somalia. But without a secure and stable government there is absolutely no way to ensure the money doesn’t end up in the wrong hands.

If the Congress members get their way, then it’s fair for Minnesota taxpayers to question whether their money, via welfare cash assistance programs, is being sent overseas. According to the Star Tribune, new Somalian refugees in Minnesota using the “family cash assistance program jumped 34 percent from 2008 to 2013, to 5,950. At the same time, food assistance participation increased 98 percent, to 17,300 adults and children, which does not include U.S.-born Somalis.”