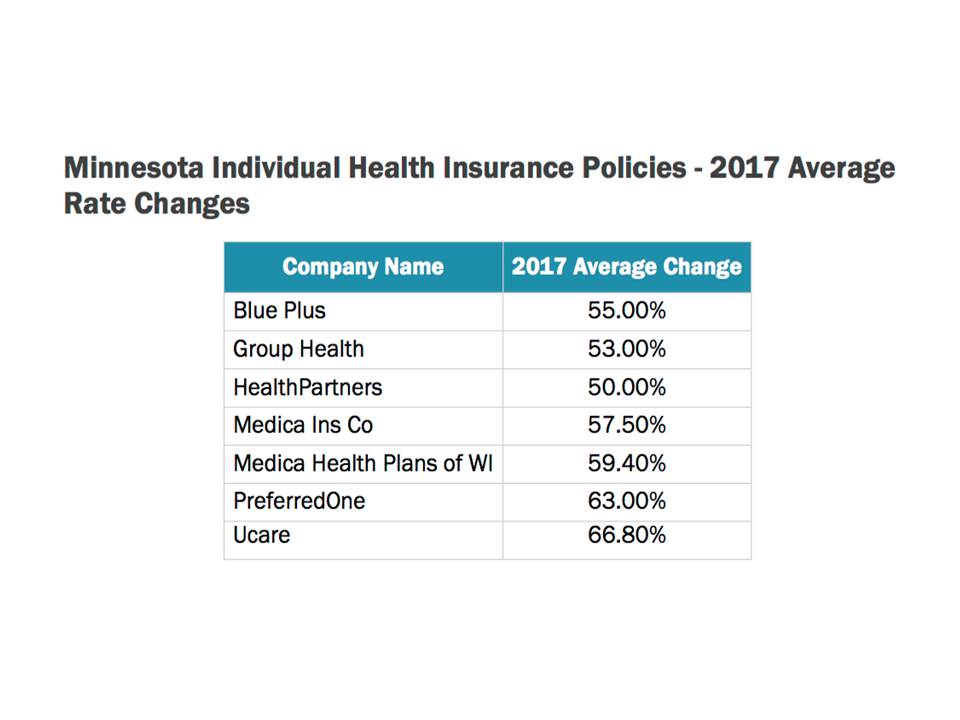

The Minnesota Department of Commerce announced Friday that rates on individual health care plans will increase somewhere between 50 and 67 percent for 2017

About 250,000 people in Minnesota purchase health care for themselves and their family individually, either through MNsure, or through insurance brokers. Minnesota’s Commerce Commissioner Mike Rothman encouraged consumers to contact MNsure to see if they qualify for federal vouchers to reduce the price. These credits are available for people who make up to 400 percent of the federal poverty level and who buy insurance through MNsure.

“The Commerce Department pursued every option within its power to avert a collapse this year,” Rothman said in a press release, “We succeeded in saving the market for 2017, with only Blue Cross leaving. But the rates insurers are charging will increase significantly to address their expected costs and the loss of federal reinsurance support. (Credit: Minnesota Department of Commerce)

(Credit: Minnesota Department of Commerce)

The increase in Minnesota is part of a much larger nationwide trend. Nearly all states are expecting to see double digit increases in costs in the next year. The issue is made worse in Minnesota due to a larger than typical number of individuals with serious medical conditions. These costs must be absorbed by the rest of a relatively small risk pool.

Another approximately 250,000 Minnesotans get their coverage from small group policies, which are typically employee benefits at companies with less than 50 employees. People who have their coverage through this means may see up to an 18 percent increase in their health insurance costs in 2017.

These rate changes do not affect most Minnesotans who get their health care from public programs like Medicaid or Medicare, or from larger employer based coverage.

“Last year at this time when rates were announced, I said there was a serious need for reform in Minnesota’s individual market,” Rothman said, “This year the need for reform is now without any doubt even more serious and urgent.”