This article was written by John Phelan and was originally published on the Center of the American Experiment’s website.

It is no secret that Minnesota is one of the most highly taxed states in the union.

We are one of the 43 states to have its own income tax, but the top rate—9.850 percent on incomes over $156,911—is higher than anywhere else apart from California, Maine, and Oregon. But it isn’t just ‘the rich’ who are hit with these high rates. Minnesota’s lowest income tax rate of 5.35 percent is higher than the highest tax rate in 23 states. Furthermore, while we exempt items like food and clothing, we have the eighth highest state sales tax in the country. Minnesota is one of only 14 states plus the District of Columbia to levy an estate tax. Eight of those 14 states and the District have a higher exemption. Our state’s starting rate of estate taxation—12 percent—is higher than any of the other jurisdictions that levy one. The top rate is 16 percent. Only the state of Washington has a higher top rate.

On business taxes, the Tax Foundation ranks Minnesota 46th out of the 50 states for its business tax climate. Minnesota imposes a deduction schedule for natural resource depletion on top of the federal one, and is one of only eight states to have an Alternative Minimum Tax on corporations, which adds another layer of compliance difficulties without raising much revenue. More importantly perhaps, Minnesota’s top rate of Corporate Income Tax is 9.8 percent. This is the third highest in the U.S. Only Iowa (12 percent) and Pennsylvania (9.99 percent) have higher rates. Evidence shows that corporate income tax rates are a big influence in foreign investment decisions. Countries increasingly have to compete on a global level for investment capital. Even after the reduction in the federal Corporate Tax rate to 21 percent, Minnesota retains one of the highest rates of corporate taxation of any advanced economy.

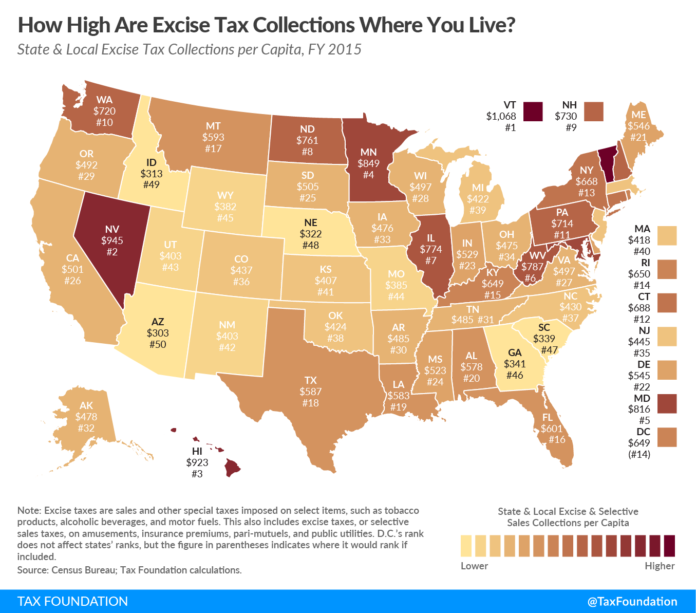

The same goes for excise taxes, which are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and pari-mutuels (betting), among other goods and activities. New data from the Tax Foundation shows that, in fiscal year 2015, our state ranked 6th nationwide for the amount of state and local excise taxes paid per person, $849.

John Phelan is an economist at the Center of the American Experiment.