(The Center Square) — Minnesota’s state and local tax collections per capita totaled $7,458, ranking 8th highest nationwide in fiscal year 2021, according to a new analysis from the Tax Foundation.

The report said Minnesota trailed Vermont ($7,552) Hawaii ($7,746), and Massachusetts ($8,103) in state and local tax collections per capita in that fiscal year.

Since fiscal year 2019, the last full fiscal year before the pandemic, the report found state and local tax collections have risen more than 27%. Much of that gain is subsumed by inflation, but even after adjusting for inflation, state and local tax revenues are more than 7% higher than they were pre-pandemic.

Contrary to initial expectations, state and local tax revenue increased during the pandemic and while the surges of 2021 and 2022 have not continued into the calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

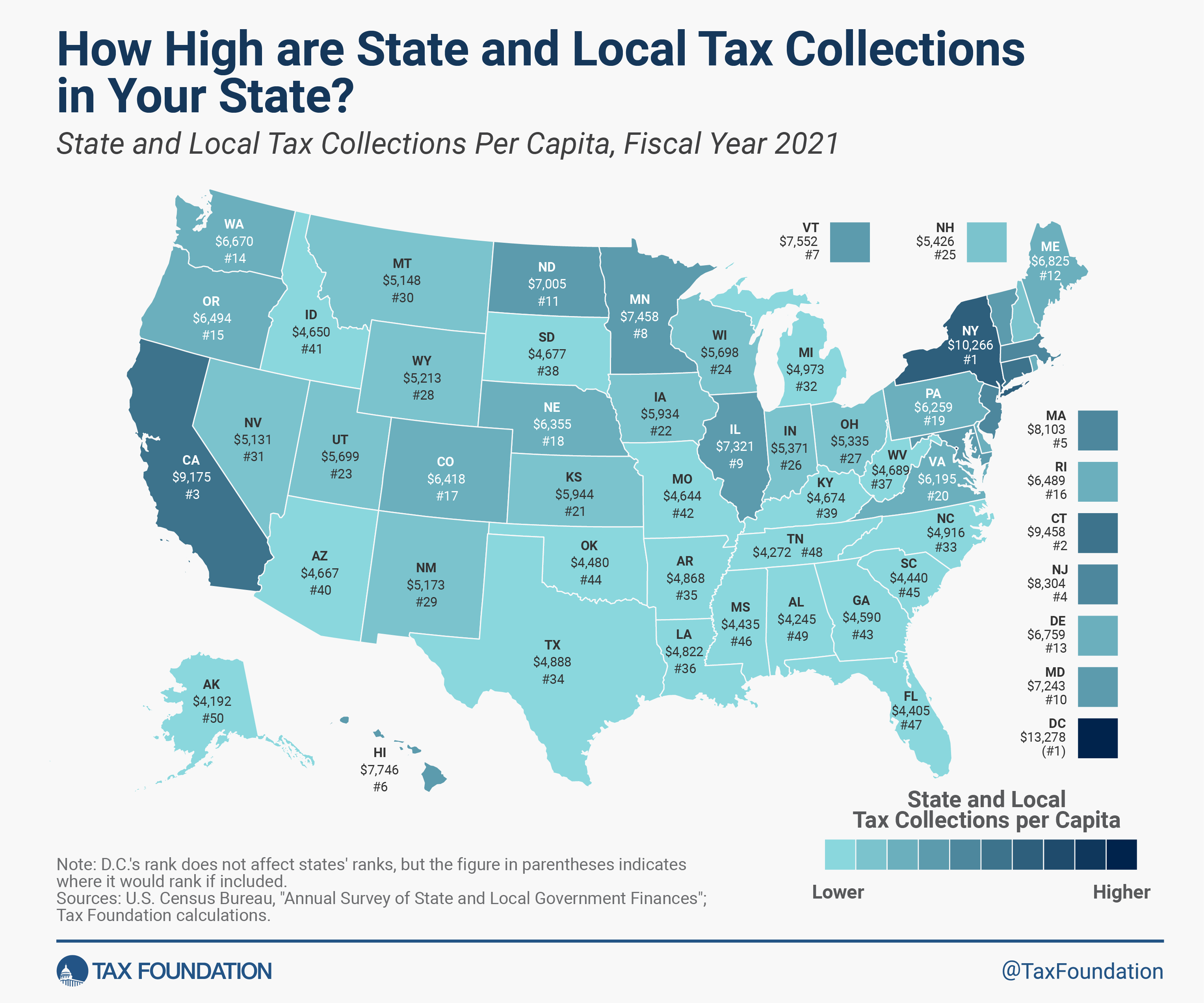

The map below shows state and local tax collections per capita in each state as of fiscal year 2021, the most recent year available.

For fiscal year 2021, the District of Columbia surpassed all states with $13,278 per capita tax collections. New York followed at $10,266 in state and local tax collections per person, with Connecticut at $9,458, California at $9,175, New Jersey at $8,303, and Massachusetts at $8,101.

At the other end of the spectrum, Alaska was lowest at $4,192, followed by Alabama at $4,245, Tennessee at $4,272, Florida at $4,405, and Mississippi at $4,435.

Revenues soared in fiscal year 2021, jumping 10% higher than pre-pandemic figures, edging up even higher in fiscal year 2022 before dropping in fiscal year 2023.

Additionally, almost every state has adopted tax cuts since the start of 2021, including 25 that have cut individual income tax rates since then, according to the report.

“The rate of revenue growth witnessed in fiscal year 2021 was never going to be sustainable, but most states remain substantially better off than they were pre-pandemic, even after adopting tax relief, with every expectation that the new baseline is far higher than it was before. Revenues are high enough, in some states, that the tax-cutting trends of 2021-2023 are likely to continue into 2024,” the report concludes.