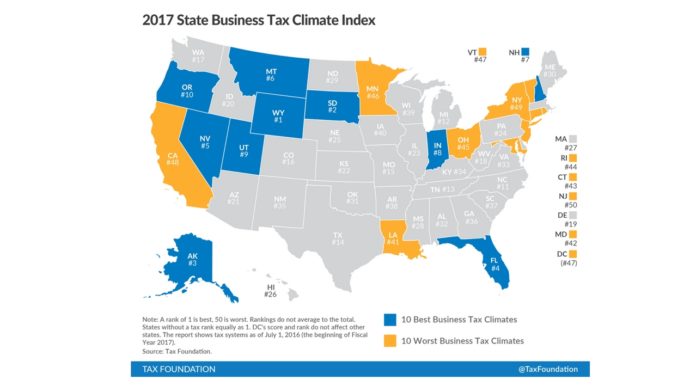

St. Paul, MN – A new report released by the Tax Foundation Wednesday shows that Minnesota ranks almost last in the country for fostering a desirable business tax climate.

The Business Tax Climate Index Report is released annually by the Tax Foundation, an independent 501(c)(3) non-partisan, non-profit organization founded in 1937. The 2017 report ranks Minnesota #46 among the states.

The report measures how well-structured each state’s tax code is by analyzing more than 100 tax variables in five different tax categories: corporate, individual income, sales, property, and unemployment insurance.

Joining Minnesota in the bottom ten states are Louisiana, Maryland, Connecticut, Rhode Island, Ohio, Vermont, California, New York and New Jersey. Ranking in the top ten are Wyoming, South Dakota, Alaska, Florida, Nevada, Montana, New Hampshire, Indiana, Utah and Oregon.

The Tax Foundation says the absence of a major tax is a common factor among many of the top ten states explaining, “property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income tax, the individual income tax, or the sales tax.”

Not everyone is convinced by the findings. Sam Fettig, the Press Secretary for the Office of Governor Mark Dayton and Lt. Governor Tina Smith, emailed the following statement to reporters:

“The Tax Foundation has an anti-tax ideology and views lower taxes as desirable. For the past two years, Minnesota has ranked in the top five best states for business by CNBC, due to our highly-educated workforce, investments in infrastructure, and high quality of life with a lower cost of living, none of which the Tax Foundation factors into its rankings.”

Fettig is referring to a July report by CNBC. This is not the first time Minnesota’s business climate has come into question, as Alpha News previously reported the Center of the American Experiment and Twin Cities Business Magazine showed there is a massive “wealth migration” taking place in Minnesota as its top earners and business owners leave the state for more tax-friendly environments.

Here is the breakdown of Minnesota’s rankings in this year’s report (1st is best, 50th is worst):

- Overall tax climate: #46

- Corporate tax structure: #43

- Individual income tax structure: #45

- Sales tax structure: #25

- Property tax structure: #33

- Unemployment insurance tax structure: #28

Subscribe to Alpha News for further coverage.