The Minnesota Department of Revenue announced that this year’s one-time rebate checks, sometimes referred to as “Walz checks,” will be federally taxed.

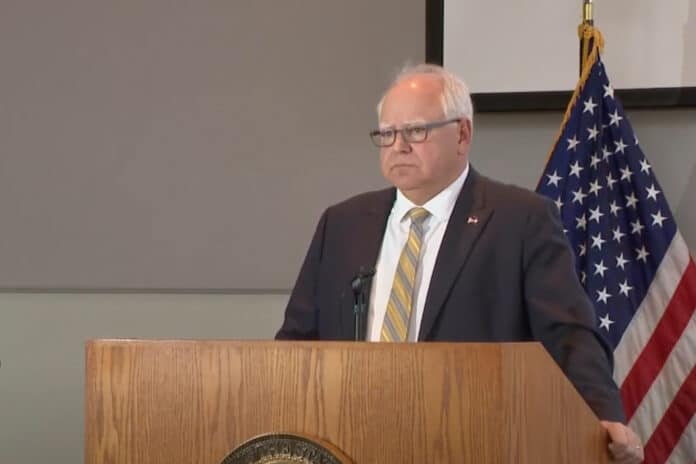

In a press conference Wednesday, Gov. Tim Walz, a Democrat, referred to this development as “bulls–t.” The governor claimed that he lobbied the Biden administration to refrain from taxing the rebate checks. However, the federal government did not listen. Regarding this decision, Gov. Walz said he was “deeply disappointed.”

While the rebate checks will be taxed at the federal level, the State of Minnesota will not tax them. Furthermore, the Minnesota Department of Revenue will send out 1099-MISC forms to all recipients of the tax rebate checks. These forms will allow Minnesotans to report the rebate check in their federal tax return.

Depending on the amount of money received in the rebate check, Minnesotans could owe between $26 and $286 in taxes to the federal government.

In August and September of this year, the Walz administration began issuing tax rebate checks to eligible Minnesotans via mail and direct deposit. The state used 2021 tax filings to determine which individuals met the requirements to receive checks. Eligibility was based on Minnesota residency, individual tax filings, adjusted gross income, and dependent status.

Single individuals received $260 and married couples received $520. Additionally, tax filers received an additional $260 per dependent with a limit of three dependents. As such, the maximum a Minnesota household could receive from a tax rebate check was $1,300.

In total, roughly 2.1 million rebate checks were issued by the State of Minnesota. Those checks amounted to almost $1 billion.

The tax rebate checks were a top priority for Gov. Walz during the 2023 legislative session. When running for reelection in 2022, Walz made a general pledge to send $2,000 checks to Minnesotans. However, that number eventually got pared down to $260 for every tax filer and dependent.