(The Center Square) — After a rollercoaster of budget projections, Minnesota flipped a projected $1.3 billion deficit into a $1.6 billion surplus for the next two years.

The $2 billion swing is thanks to federal stimulus packages passed since November, which is only one-time money, and lower state spending.

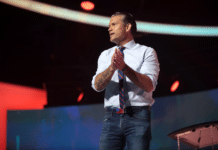

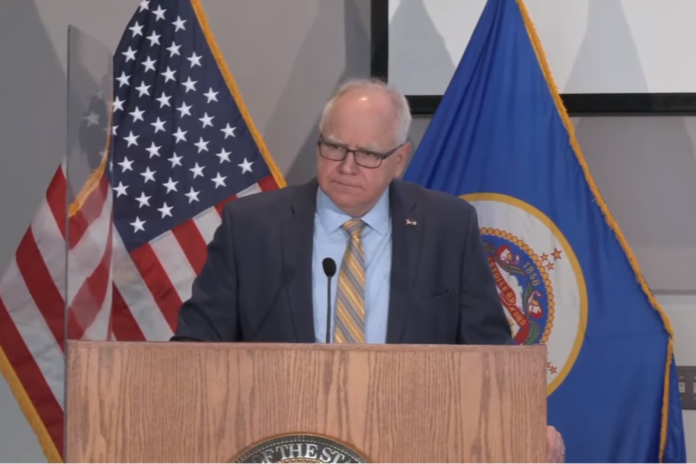

Gov. Tim Walz welcomed the new estimate.

“It proves that the measures we took during the pandemic have both saved lives and protected the economy,” Walz said in a statement.

“As we come out of COVID-19, we can’t forget the sacrifices so many of our workers and small businesses have taken to protect their communities. They’ve been heroes throughout the past year, sacrificing their own bottom line for their neighbors. And they saved lives. That’s why my budget focuses on leveling the playing field to support working families and small businesses.”

The announcement paves the way for a budget negotiation. Walz proposed a $52.4 billion budget with $1.6 billion in tax hikes, mainly comprised of three taxes.

Walz proposed a fifth-tier income tax rate for household incomes above $1 million or a single earner anticipated to bring in $500,000 or more, which would shift Minnesota from the fifth-highest state income tax in the nation — 9.85% on taxable income over $164,400 a year — to the third-highest state in the nation.

Walz aims to increase the corporate tax rate for profitable companies from 9.8% to 11.25% starting in 2021 to reap $424 million, which would bump Minnesota to the second-highest corporate tax rate in the nation, behind New Jersey’s 11.5% tax rate.

Walz’s proposed budget seeks a higher tax rate on capital gains: 1.5% on sales profits between $500,000 and $1 million, and 4% if more than $1 million.

Fluence Media Principal Blois Olson tweeted that Walz still intended to keep his proposed $1.6 billion in tax hikes in his budget.

The Minnesota Chamber of Commerce said lawmakers should use the surplus to give roughly $411 million in tax breaks in fiscal year 2022 through not taxing Paycheck Protection Program (PPP) loans as state income.

“It’s time for lawmakers to help struggling employers, employees, and communities; not create permanent tax increases and barriers to growth,” the group said in a statement. “Preventing a state income tax to hit those employers who took the federal PPP loan lifeline to maintain staff throughout the pandemic is a critical first step.”

Minnesota is the one of a few Midwest states that currently plans to tax PPP loans as state income.

Senate Finance Committee Chair Julie Rosen, R- Fairmount, said the announcement was “good news.”

“But it does not change the fact that our state budget is unsustainable and has been for a long time,” Rosen said in a statement. “As chair of the Senate Finance Committee, I’ve got two priorities for the budget: first, we will be looking into government spending, government accountability, and seeing where this money is going. Second, Minnesota workers and small business owners are still struggling. Let’s get them some targeted tax relief.”

House Speaker Melissa Hortman, DFL-Brooklyn Park, said in a statement the announcement was good news, but the current budget “doesn’t currently meet the needs of all Minnesotans.”

“Every day there are Minnesotans who struggle and find it hard to make ends meet while there are others who have more than enough to get by. We must pull together and make the investments all Minnesotans need to recover from the pandemic and thrive once it’s over.”

Senate Majority Leader Paul Gazelka, R-East Gull Lake, said the Senate will vote next week whether to give companies that took federal loans a state tax break.

House Minority Leader Kurt Daudt, R-Crown, said the surplus was another reason not to raise taxes.

“Raising taxes will slow our economic comeback, and make it harder to bring back jobs and paychecks to where they were before the pandemic,” Daudt said in a statement.

“We know the governor’s tax hikes will not become law this year, and we can save ourselves weeks of headaches if the governor and Democrats acknowledge that now. We’re ready to roll up our sleeves and work together to pass a responsible budget without raising taxes.”