President Joe Biden promised his tax hikes would only affect the rich, yet his excessive spending and overall economic agenda created our inflation woes. Inflation crushes the Americans Biden and Democrats claim to care about, since it mostly targets the lower, middle class, and those most vulnerable to price increases on vital staples like food and gas.

And oh, the timing. The stock market is booming, Americans are flush with cash, and the economy is restarting after the lockdowns.

Yet the Wall Street Journal reported this week that “Americans should brace themselves for several years of higher inflation than they’ve seen in decades, according to economists who expect the robust post-pandemic economic recovery to fuel brisk price increases for a while.”

The Bureau of Labor Statistics followed up Tuesday by noting the Consumer Price Index jumped 0.9 percent in June, its largest monthly increase since 2008.

Americans who live in reality know this, as inflation worries hit their highest level in eight years.

A recent survey found 71 percent of voters believe inflation is a “very big” problem, and that number rises to almost 80, when you replace “inflation” with “rising prices.”

Consumer prices have increased at an accelerated rate every month this year. Commodity prices are also skyrocketing, with lumber jumping to four times its usual rate, and copper hitting a record high. Average gasoline prices nationwide have risen by over 40% since Biden was elected, surpassing $3 per gallon nationwide.

Inflation, seeing the largest increase in 13 years, is a tax on everyone, because it reduces the value of earnings. It also devastates those on fixed incomes, and hurts small businesses, which must constantly raise prices, alienating customers.

Inflation is also disruptive, since business planners can’t be sure what costs are what they will be in six months. For example, it is tough to bid on a job when you don’t know what the cost of supplies will be in 2022.

Last month, the Fed signaled it will keep interest rates at zero for the next few years, so inflation is unlikely to slow down. The Biden administration hopes rates won’t jump until after the 2022 elections, to avoid fallout at the polls from their failed policies.

Fed Chair Jerome Powell told lawmakers Wednesday that inflation “has been higher than we’ve expected and a little bit more persistent.”

Sen. Pat Toomey, Banking Committee ranking member, pushed back, telling CNBC, “Inflation is now with us; we are not speculating. The Fed has underestimated the level of inflation, and if they’re wrong about how brief it can be, they’ll be behind the curve and reacting late.”

Progressives spent $2 trillion on their partisan “relief plan” in March, and Biden is proposing trillions more in spending, which would be the biggest expansion of government since the 1960s.

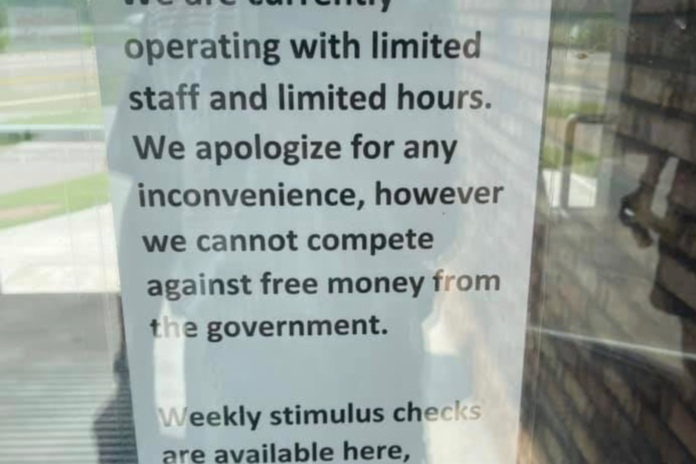

Democrats are paying nearly half of recipients more to stay home than return to work. Small businesses cannot compete with government largesse.

The Labor Department recently revealed there are over 8 million unfilled jobs nationwide, signifying the largest shortage in a generation. So desperate to get folks off the couch, businesses are paying above-market wages, then passing the cost on to customers with higher prices, a 5 percent annual growth, the sharpest jump in 13 years.

And what good are higher wages if they’re canceled out by higher prices?

“Biden’s $1,400 checks primed the pump for an artificial spending spree,” an economist told Alpha News. “Consumers had extra time and money, so they pushed up prices for goods in short supply. This sudden demand occurred at the same time as widespread supply chain bottlenecks. It was an imperfect storm.”

Does Biden, who’s been engaging in misinformation lately, want his presidency defined by inflationary fears? Probably not.

That’s likely why the administration finally invited Larry Summers — Barack Obama’s NEC director, who ripped March’s American Rescue Plan as “the least responsible fiscal macroeconomic policy we’ve have had for the last 40 years” — to the White House.

“These figures and labor market tightness and the behavior of housing markets and asset prices are all rising in a more concerning way than I worried about a few months ago,” Summers said. “This raises my degree of concern about an economic overheating scenario.”

Ron Klain, Janet Yellen and Co. should listen to Summers, not radicals who hope to pass a $3.5 trillion, economy-crushing bill on irrelevant issues that costs more than all combined federal revenues from last year.

A.J. Kaufman

A.J. Kaufman is an Alpha News columnist. His work has appeared in the Baltimore Sun, Florida Sun-Sentinel, Indianapolis Star, Israel National News, Orange County Register, St. Cloud Times, Star-Tribune, and across AIM Media Midwest and the Internet. Kaufman previously worked as a school teacher and military historian.