There was no disagreement among DFLers and Republicans on the Senate floor Monday over whether Minnesota workers across all industries want and need expanded access to paid family and medical leave benefits.

To what degree the state should provide those benefits is where the differences between caucuses were stark and along party lines, as senators debated the highly controversial HF2 for more than six hours before the DFL’s one-vote majority held together to pass the bill.

The legislation — which Gov. Tim Walz has promised to sign — would establish a state-run insurance program that would tax both employees and employers to fund a paid family and medical leave program that provides workers up to 12 weeks of paid family leave and 12 weeks of medical leave per year. The program would be funded by an increase on payroll taxes and go into effect by July 1, 2025. It would also create a new state agency that would oversee the program, with administrative costs estimated to be about $40 million annually.

Replacement wages would average about 66 percent of an employee’s income. Those benefits would be funded by a 0.7 percent payroll tax. Employers would be allowed to charge half that expense to employees, according to language in the bill. Companies offering more generous benefits than the state requires could opt out.

Eleven other states and the District of Columbia already have similar programs, though Minnesota’s would be among the most generous, according to bill sponsors in both chambers.

The Senate’s passage of the bill on Monday follows its passage on a 68-64 vote in the House last week, where two DFLers — Dave Lislegard, of Aurora, and Gene Pelowski, of Winona — joined Republicans in opposing the bill.

No Republicans in either chamber voted to support the bill. They say the legislation’s “one-size-fits-all” approach will create unsustainable financial and workforce burdens for small business owners across Minnesota who employ more than 1.3 million people.

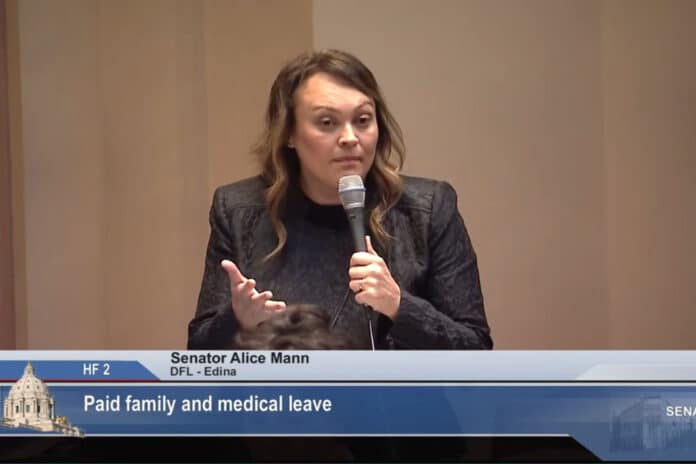

But Democrats — including lead author Sen. Alice Mann, DFL-Edina, — weren’t having any of it, despite receiving strong criticism from a number of organizations that represent small business owners.

“How many times did we hear (from Republicans) today the argument, ‘Businesses will shutter their doors. Businesses will close down. We can’t have people walking off the job for 12 weeks,’” Mann said in her closing remarks before the bill she authored in the Senate passed without a Republican vote.

“I mean how dare you live a life outside your employer,” Mann exclaimed with a deadpan tone of sarcasm she directed at her Republican colleagues on the Senate floor. “This bill does not create a need for leave, it simply changes the way we treat people when they take a very necessary leave for work.”

Senate DFLers balk at GOP paid leave plan that passed with bipartisan support in 2022

After two House Democrats from Greater Minnesota voted against HF2 last week, there was some hope among Republicans that an amendment Sen. Julia Coleman, R-Waconia, offered to replace the mandatory component in HF2 with a voluntary paid leave insurance program may gain support from at least one Democrat.

While Coleman authored a paid family and medical leave bill during the 2022 legislative session that passed with bipartisan support in the Senate, the DFL majority in the House never gave it a hearing. Its components mirrored the amendment Coleman offered on the floor Monday. That amendment would have replaced HF2 in its entirety and eliminated the mandate on employers, but allow them to voluntarily enroll in a plan the state provides via a preferred insurance company.

Employers participating in that plan would receive small business tax credits as incentive to enroll in the program, which Coleman described as “the first, right step.”

“Other states are starting to roll this out,” Coleman told her colleagues, “and while, in most states, the plan is so new that it’s not yet available for purchase, I believe its ability to fill in the gaps in the system is promising.”

Coleman’s amendment failed on a party-line vote, with no support from Democrats. Just one year ago, a bill she authored to create the same program cleared the Senate on a 37-29 vote that included support from DFL-elected senators Tom Bakk, Dave Tomassoni and John Hoffman. Both Bakk and Tomassoni retired. Hoffman, of Champlin, voted against Coleman’s amendment on Monday, but didn’t speak during the six-hour debate on the bill.

Bakk’s replacement in the Senate is Grant Hauschild, a 34-year-old North Dakota native who served one year on the Hermantown City Council before running to replace the veteran legislator. The first-term DFLer voted to support HF2, which he said would “bring transformational change” to Minnesotans.

“I’ve had several conversations with stakeholders across my district, from small businesses to labor organizers,” Hauschild said in a speech he delivered on the Senate floor explaining his support for the bill. “I applaud bill author Sen. Alice Mann for taking some of my suggestions to make this bill work for the Northland.” Hauschild didn’t mention what those suggestions were. Earlier in session, he didn’t chime in on the bill when it received a hearing in the Jobs Committee of which he is a member.

Sen. Jason Rarick, R-Princeton, said the DFL’s bill is “the inferior paid family and medical leave option.”

Although a large number of Minnesotans do support paid medical leave, Rarick said a very small minority support the bill Democrats passed on the Senate floor that would “raise taxes on all employees and all employers to set up a whole brand new state bureaucracy with hundreds of new state employees.”

“Unfortunately the bureaucracy is going to be a big winner under this bill,” Rarick said.

Superintendent says schools will struggle to adapt to mandate

Earlier in the day Coleman held a press conference announcing she would offer her amendment on the Senate floor. She was joined by small business owners and Stillwater Area Schools Superintendent Mark Funk.

“As a larger employer, I am supportive of paid family and medical leave,” said Funk, a school superintendent for nearly two decades. “I’m also a veteran school superintendent who is quite aware of the second and third order effects of bills such as this one. And I think this is something folks need to be aware of. Even though we have a historic surplus in Minnesota, we are being asked to pay for this program through a new tax.”

While Education Minnesota has lobbied in support of the legislation, Funk said school districts will struggle to find ways to pay the costs for another unfunded mandate.

“So in addition to the payroll tax, we are compelled to pay for replacement staff with no additional funding from the state. That leaves us with less resources to compensate our employees.”

Hank Long

Hank Long is a journalism and communications professional whose writing career includes coverage of the Minnesota legislature, city and county governments and the commercial real estate industry. Hank received his undergraduate degree at the University of Minnesota, where he studied journalism, and his law degree at the University of St. Thomas. The Minnesota native lives in the Twin Cities with his wife and four children. His dream is to be around when the Vikings win the Super Bowl.