As state lawmakers gear up to tackle the opioid crisis in the upcoming legislative session, Minnesota’s two leading gubernatorial candidates differ widely on their approaches to the problem.

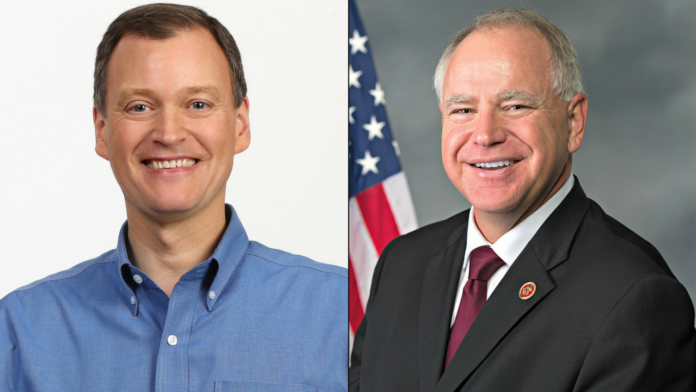

A controversial proposal that continues to be a point of debate is the penny-a-pill surcharge that would tax pharmaceutical companies on the opioids they sell. The measure received some attention last session, but was stripped from legislation due to a lack of widespread support. However, the proposal continues to remain an issue heading into the midterms, and gubernatorial candidates Tim Walz and Jeff Johnson are weighing in.

Walz has expressed support for the so-called “stewardship fee,” indicating that he would continue outgoing Gov. Mark Dayton’s efforts on the matter. Proponents of the proposal, including Walz, consider it a way to punish the pharmaceutical companies and make them share the financial burden of a potential solution to the crisis.

Johnson, on the other hand, believes the proposal does nothing to punish the pharmaceutical companies, because the increased costs will be passed directly to the consumer. With the high cost of prescription drugs already a concern, Johnson says a new tax wouldn’t “move us in the right direction.”

“I don’t support the penny-a-pill because when we are already concerned that health care and prescription drugs are way too high for people, adding a tax to them doesn’t seem to move us in the right direction,” Johnson said. “They are going to pass on every penny of that to the consumer. There’s just no way around that.”

Johnson says it is a very small amount of prescriptions that are being abused or misused, but everybody would have to pay higher prescription prices under the penny-a-pill proposal.

“And by the way, everything I’ve read about that, it really isn’t a penny-a-pill, it’s considerably higher,” Johnson added. “I just don’t think when we already have a problem with affordability that adding a new tax on top of what is already there is going to solve the problem.”

Evidence supports Johnson’s claims that the tax would be considerably higher. In New York where a penny-a-pill initiative has recently been implemented, the tax is expected to be about 10 cents for lower-strength opioid pills and even more costly for more powerful ones, according to a report from Kaiser Health News.

Walz has stated he supports the tax as a means of funding prevention and recovery efforts. During a forum focused on the opioid crisis at Woodbury Lutheran Church last Friday, Walz called on drug companies to be involved in the solution.

“There is no one easy fix to this crisis,” Walz said. “But there is a public commitment to getting it right.”

While Johnson agrees there are far too many overdoses from prescription opioids, he says it is really only one part of the crisis. The underlying problem–the addiction itself–would be a focus of his administration, as well as ensuring law enforcement has the tools necessary to fight incoming illegal opioids.

Johnson has also praised the multi-faceted bill on the opioid crisis that passed through the legislature last session only to be vetoed during the budget scuffle at the end of the session. The bill, he says, is a “good starting point” to make quick progress.

“I think that’s a good starting point,” Johnson said. “Let’s revise that because it’s bipartisan. Let’s get it done, let’s have a governor who actually signs it. That’s easy and quick progress.”