Minnesota’s budget surplus was large and growing just two months ago. One $4 billion drop later, the situation looks very different.

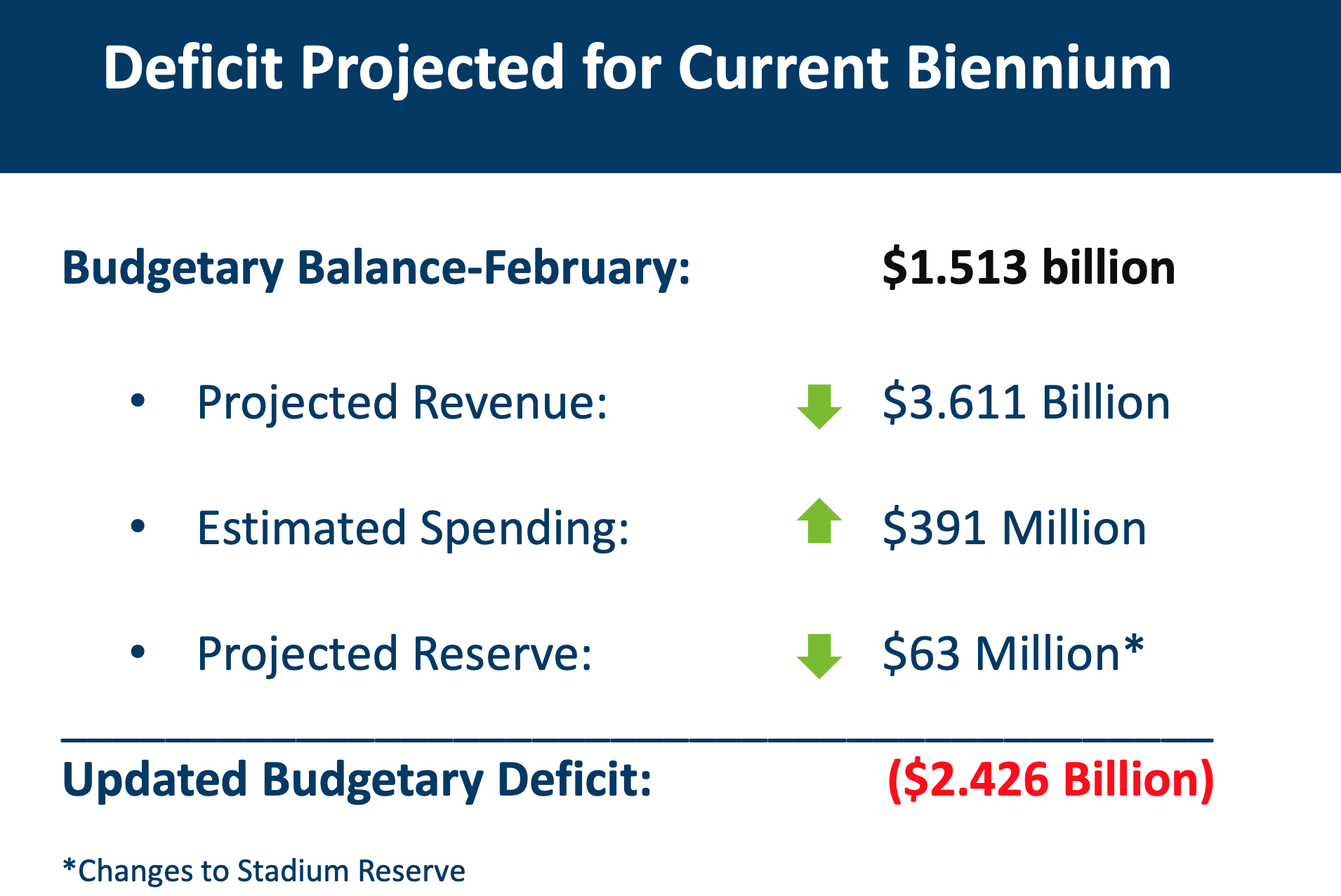

In February, Minnesota Management and Budget forecasted that the state’s $1.3 billion budget surplus would grow to over $1.5 billion according to MPR. However, the agency now predicts a deficit of over $2.4 billion for the current two year budget period which terminates mid 2021, according to News Advance.

Minnesota Governor Tim Walz acknowledged his state’s poor financial situation on Twitter, warning citizens to brace for a “long winter” before appearing to call for more spending.

Our updated budget outlook confirms what we suspected: COVID-19 will damage Minnesota’s economy. There is a long winter ahead. COVID-19 is upending life as we know it—and our economy will not be spared.

— Governor Tim Walz (@GovTimWalz) May 5, 2020

Republican State Representative Steve Drazkowski blamed the governor himself for this move into the budgetary red. “Walz unwisely took a sledgehammer to Minnesota’s economy, and we are all suffering for that decision,” he said in a press release, Tuesday.

“The governor will use this budget shortfall as an excuse to increase taxes,” he also predicted, adding that “we cannot allow state government to double-dip into the pockets of hard-working Minnesotans. The new budget projection demonstrates that Minnesota needs to limit government, cut budgets, and not take more money from Minnesotans who are already struggling due to Governor Walz’s decision to shut down our economy.”

Minnesota economist John Phelan seems to agree with Drazkowski. “Politicians should not use the budget deficit as an excuse to increase taxes, especially during an employment crisis that rivals the Great Depression,” he said in a press release, Tuesday.

“Minnesotans are already some of the most heavily taxed citizens in America… Our lowest income tax rate of 5.35% is higher than the highest tax bracket in 25 states,” he says.

Minnesota has a $2.359 billion rainy day fund that could likely be used to alleviate the deficit without increasing taxes. The state originally amassed this large reserve fund along with the surplus it used to have in 2019, after a year of fruitful sales and income tax collections paired with downsized spending, reports MPR.