Peter Schiff recently took to Twitter to vent his frustration with the student loan debt relief plan being implemented by the Biden administration. Schiff argued the plan would create a number of backwards incentives that would encourage borrowers to pursue expensive, low-paying majors, underreport their incomes, and avoid paying back their loans in full.

The reason #students pay for #college, rather than borrow, is to avoid future interest payments. But thanks to income based repayment, most borrowers will only have to repay a fraction of what they borrow. Since college will be so much more expensive for those who pay, few will.

— Peter Schiff (@PeterSchiff) August 26, 2022

His ire was focused primarily at the income-based repayment component of the plan that would cap monthly payments for an undergraduate education at 5% of discretionary income, broaden the definition of “discretionary income” to 225% of the federal poverty level (a little over $30,500 for a one-person household), forgive outstanding debt after 10 years on loans with a balance less than $12,000, and prevent interest from accruing on loans as long as the principal is paid each month.

Capping student loan repayments at 5% of incomes and then forgiving unpaid balances after just 10 years, will encourage students who major in subjects that will qualify them for the lowest paid jobs to borrow the most amount of money. Can you think of a more asinine system?…

— Peter Schiff (@PeterSchiff) August 26, 2022

Schiff pointed out that the income-based repayment scheme creates all sorts of adverse incentives that would further exacerbate the student loan debt crisis, which recently hit a new all-time high with outstanding loans now totaling $1.75 trillion, or an average of $58,957 per household.

The cap on loan payments would encourage students who pursue low-paying jobs after graduation to take on larger amounts of debt since their lower incomes would shield them from having to pay the real cost of their loans, and those who end up with higher-paying work would be emboldened to obfuscate what income they do earn from the IRS to both minimize their loan payments and tax liability. This broad combination of negative outcomes led Schiff to chaffingly characterize the plan as an “asinine system” and suggest “it’s not a coincidence” that the IRS plans on greatly expanding their workforce given how many more borrowers will be trying to underreport their income.

It's not a coincidence that 87K more IRS agents are being hired and student loan repayments will be capped at just 5% of incomes and forgiven after 10 years. People with large loans will have greater incentives to under-report their incomes, to avoid both taxes and loan payments!

— Peter Schiff (@PeterSchiff) August 26, 2022

The student loan debt relief plan was announced by the Biden administration ahead of a looming midterm election cycle, where Democrats face increasingly uncertain prospects following chronic record high inflation, ongoing supply chain issues, and what many people see as a disorganized, reactionary executive branch.

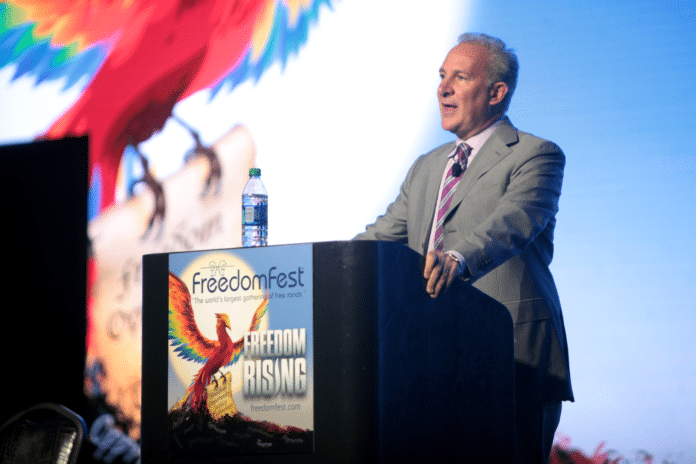

Schiff is frequently perceived as a controversial figure due to his consistently bearish outlook and belief that the U.S. should return to the gold standard. He first gained mainstream prominence during the financial crisis following prophetic statements he made in a series of television interviews in 2006 warning about the upcoming crash. His brusque style and skeptical tone regarding the state of the U.S. financial system had earned him the nickname “Dr. Doom,” a moniker that carries to this day.