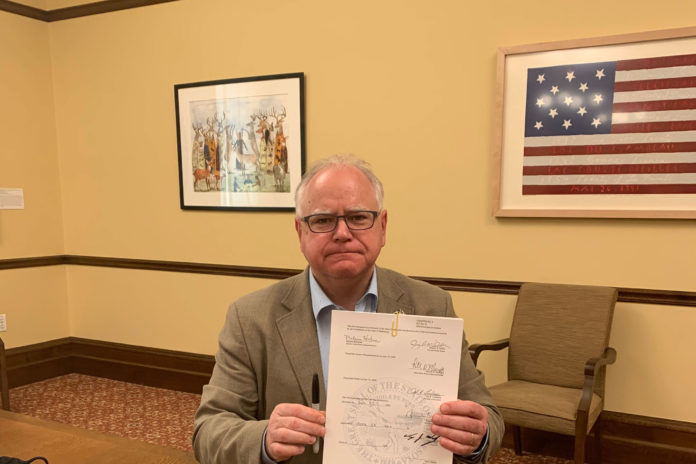

(The Center Square) – Gov. Tim Walz’s administration was handed a “D” in fiscal management by a national libertarian think tank.

The Cato Institute, headquartered in Washington, released its “Fiscal Policy Report Card on America’s Governors 2020” on Monday.

Cato gave Walz a “D” – a grade given to 13 other governors – eight Republicans and six Democrats.

Four governors received an “A” on the Cato report card: Chris Sununu of New Hampshire, Kim Reynolds of Iowa, Pete Ricketts of Nebraska, and Mark Gordon of Wyoming. All four governors are Republicans.

“There have been some high‐scoring Democrats in past Cato fiscal reports, but Republican governors tend to focus more on tax cuts and spending restraint than do Democrats,” the report states.

Walz entered office when Minnesota was projected to have large budget surpluses in the future, thanks to former Democrat Gov. Mark Dayton’s administration.

“Rather than save the excess or give it back to taxpayers, Walz planned to spend it and then increase taxes to fund even more spending,” the report reads. “But Walz had to compromise with the legislature and the final tax increase passed last year was about $330 million annually, mainly consisting of base broadening related to the federal [Tax Cuts and Jobs Act of 2017].”

The report notes Walz pushed for higher gas taxes and vehicle fees to raise about $1 billion annually for transportation, but “[f]ortunately for Minnesota taxpayers,” the plan was abandoned in the final budget.

Before the COVID-19 pandemic, Minnesota’s February forecast projected a surplus of $1.53 billion.

Now, it’s facing a projected $4.7 billion deficit for the 2022–2023 biennium.

Walz has wrestled with the Legislature on spending federal COVID-19 aid, a bonding bill, and police reforms in the wake of George Floyd’s death by a Minneapolis police officer in May 2020, which sparked worldwide protests.

The grading rubric analyzed governors’ respective tax and spending records. Governors able to rein in spending and limit tax increases received higher grades than those who taxed and spent without restraint.

A September report handed the state a “B” for its taxpayer surplus of $100 per capita– determined by dividing the state’s debt by the number of taxpayers.

This year is the 15th time the Cato Institute has released its biennial report.

For states seeking to balance budgets with no tax increases, Cato recommended more efficient ways of collecting revenues from legalized marijuana and saving taxpayer dollars by prohibiting public-sector collective bargaining. The libertarian think tank also advocates for establishing state rainy day funds and encouraging stable and pro-growth tax bases.

“With the 2020 health crisis and recession, governors across the nation are facing tough fiscal choices,” the Cato report said. “However, the need for restraint and recovery provides an opportunity for governors to prune low‐value spending from state budgets and to pursue growth‐enhancing tax reforms.”

– – –

This article was republished with permission from The Center Square.