Minnesota’s projected budget surplus swelled to $9.253 billion, up from $7.7 billion, in an updated forecast released Monday by Minnesota Management and Budget.

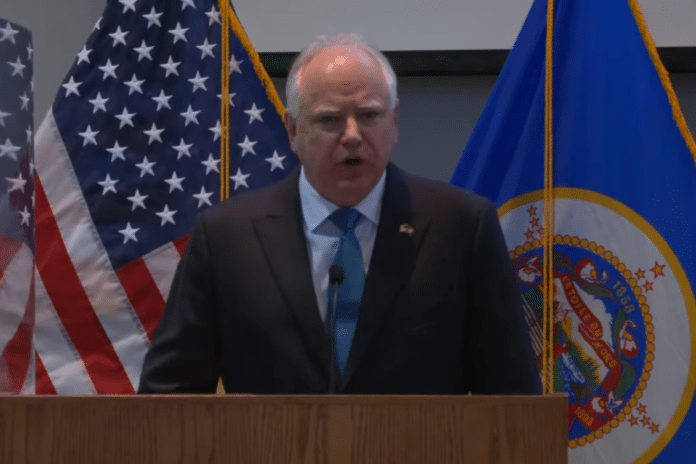

The projected $1.507 billion increase for the current biennium was described as a “good position for Minnesota to be in” by Gov. Tim Walz during a Monday afternoon press conference.

“What this gives us is an opportunity as Minnesotans to make sure that we’re investing in Minnesotans right now,” Walz said.

The state’s budget agency, however, cautioned that “uncertainty due to inflation and geopolitical conflict pose risk to the budget and economic outlook.”

“The good news is we can compromise on a whole lot of fronts to make life cheaper for Minnesotans both now and in the future. We can continue to invest in things like education and health care, reducing those costs, making them more accessible to folks,” Walz added.

Republicans are calling for “permanent, meaningful tax relief.”

“The massive surplus continues to get larger, meaning the state government is simply collecting too much money from the taxpayers. It’s time to give the money back to the people with permanent tax relief for Minnesotan workers and senior citizens,” said Senate Majority Leader Jeremy Miller.

Sen. Julie Rosen, chair of the Senate Finance Committee, called the projected surplus “out of control.”

“A $9 billion surplus means government took way too much from taxpayers at a time when people are still struggling to afford everyday life. We have a duty to give it back with real, permanent, significant tax relief. No election-year gimmicks or one-off checks. Minnesotans deserve real tax relief. There’s no excuse,” she said.

Republicans are pushing a proposal that they describe as the “biggest tax cut ever,” which would reduce the first-tier income tax rate from 5.35% to 2.8%. House Democrats rebuffed the proposal as a tax break for “millionaires and billionaires.”

Gov. Walz has proposed using some of the surplus for one-time checks of $175 for single tax filers and $350 for married filers. Republicans say they would like to see more “permanent” relief.

“The Democrat tax-and-spend agenda, combined with the Biden inflation, has created crushing prices for gasoline, food, energy, housing, and almost everything else,” said Rep. Eric Lucero. “Government has plenty of extra cash from high taxes while good people are suffering.”